Traditional investment approaches often fail to protect retail investors during market downturns. The pandemic market crash exposed this vulnerability, with even experienced investors suffering substantial losses. Many lost their retirement savings, the fear-induced selloff wiped off $3 trillion from U.S. retirement accounts. Many saw their dreams of financial freedom delayed, or had years of careful investing wiped out—forcing them to constantly monitor the market just to recover.

This is when a team of experienced financial and deep-tech professionals came together to develop a solution focused on tactical investing to minimize risk and maximize diversification. They sought to make investing simpler, safer, and more accessible.

Their approach was to democratize active management solutions, disrupting the wealth management industry by providing tools that react to market changes and rebalance portfolios automatically, ensuring better risk management for retail investors.

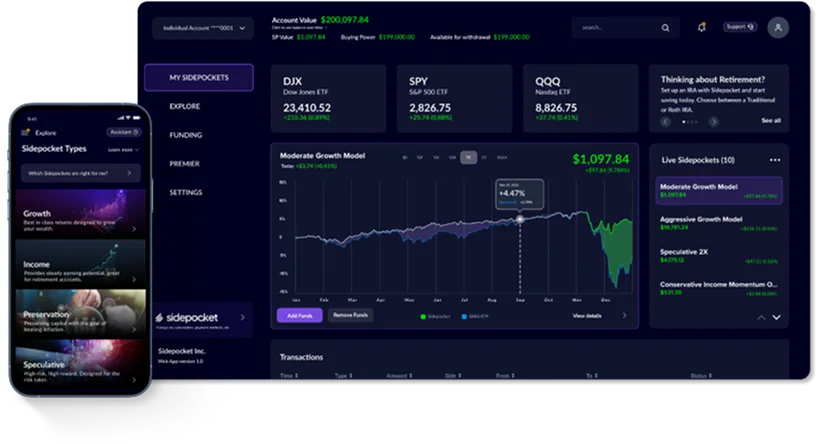

Today, Sidepocket is a SEC-Registered Investment Advisor offering a platform designed for personalized risk-aware investing with automated portfolios with quantitative modeling, active rebalancing, and tactical asset allocation to retail investors.

Sidepocket was growing rapidly, but with growth came challenges. Their platform needed to handle:

Users needed comprehensive portfolio visibility but the existing monolithic architecture couldn't efficiently manage the increasing data volume.

As user numbers grew, transaction processing became increasingly sluggish, affecting user experience and trust.

The platform lacked the ability to offer varied billing cycles, limiting monetization options.

Real-time stock data processing was creating excessive load on the backend, threatening system stability during peak trading hours.

Sidepocket needed a transformation—one that would fortify its backend infrastructure while enhancing speed, security, and user satisfaction.

To address these challenges, we engineered scalable, efficient, and secure backend infrastructure tailored to Sidepocket’s needs. Our approach focused on five key areas:

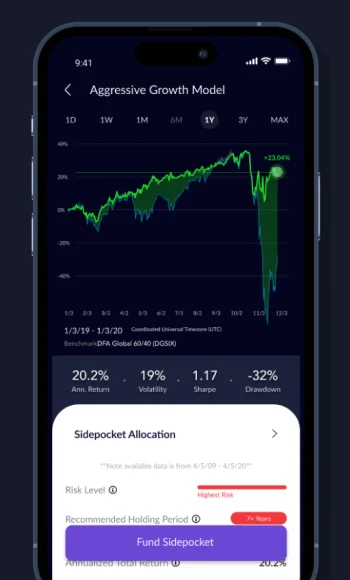

To enhance the user awareness regarding the associated risks with the portfolio, once the user has successfully transferred the funds, and has a portfolio, we have facilitated the platform to notify the users regarding the risk levels associated with their existing portfolio with Twilio implementation. Further, we have also implemented a feature that recommends holding periods to help you be on top of risk-aware portfolio holdings.

A portfolio that does not update in real-time led to inaccurate tracking of stock holdings and transactions.

We integrated Apex, a powerful trading API, to process buy/sell requests in real-time. This was supported by AWS DynamoDB implementation, which created a serverless, auto-scaling database environment that efficiently manages real-time stock data with sub-millisecond response times. As a result, Sidepocket users now receive accurate, real-time portfolio data, improving investment decision-making.

The existing system was unable to handle a high volume of trade requests efficiently, leading to execution delays.

By leveraging Apex’s trade execution API within a microservices architecture, we ensured that trades were processed independently, reducing wait times and eliminating backend congestion. This enabled fast, reliable trade execution, improving user confidence in the platform.

Sidepocket needed to enhance security while maintaining an easy login experience for users, including the retail professionals as well as the admin team.

We introduced Keycloak to manage authentication and security for the admin panel, ensuring that platform administrators had a secure and controlled access environment. For user authentication, we implemented Twilio for message-based verification, adding an extra layer of security to prevent unauthorized access while maintaining a smooth login process.

Users faced difficulties in linking their bank accounts, making deposits, and withdrawing funds seamlessly.

Our Plaid integration addressed critical security and connectivity challenges in linking users' banking information. This enhancement has not only strengthened security but also reduced user onboarding friction

Additionally, Stripe was integrated to streamline financial transactions, including billing cycles and transaction charges. This ensured a seamless, hassle-free financial experience for users. The system now supports automated recurring billing with customizable billing cycles, instant deposits for immediate trading capability, and streamlined withdrawals with significantly reduced processing times.

The backend system was struggling under increasing user demand, affecting performance and reliability.

We engineered a high-performance backend infrastructure capable of handling massive data volumes without performance degradation. Apart from using microservice architecture, we used Kubernetes to automate service deployment on the server. This allowed Sidepocket to dynamically scale resources based on real-time demand, ensuring consistent performance even during peak trading periods.

Maintaining strict data integrity across all platform touchpoints was challenging

We developed a comprehensive API framework that serves as the communication backbone for the entire ecosystem. This REST API architecture facilitates seamless data exchange between the frontend applications (both mobile and web interfaces), backend microservices, and all third-party integrations. Each component now communicates through standardized, secure API calls, enabling independent scaling and updates without system-wide disruptions.

Through our strategic implementation, we delivered a transformative impact on their platform, enhancing its value for both stakeholders and end users.

By addressing Sidepocket's specific pain points through a microservices architecture and strategic third-party integrations, our solution has enabled the client to fulfill their mission of making investing simpler, safer, and more accessible to everyday individuals. The platform now delivers institutional-grade investment capabilities while maintaining the performance, security, and flexibility needed to support Sidepocket's continued growth in the competitive wealth management sector.

The successful transformation underscores the value of microservice architecture in financial technology applications where real-time data processing, security, and scalability are paramount concerns. Our technical expertise and implementation methodology have positioned Sidepocket for sustained growth and technological leadership in their industry.

Contact us today to learn how our solutions can help you deliver projects more efficiently and successfully.