Empowering financial institutions to thrive in an era of volatility, hyper-personalization, and regulatory complexity through AI-driven innovation, data-driven insights, and Digital Twin-powered foresight.

From working with a leading investment banking firm in the Asian market to developing a smart investment platform to enabling a fintech firm with a cutting-edge personal finance management solution, we partner with institutions driving the future of finance.

From catering to the tier 1 banks to challenger banks, we help these entities to deal with legacy core banking setbacks, fraud losses, and inability to personalize services at scale by offering our advanced technology solutions.

From asset managers to PE/VC firms, we cater to the institutions in the non-banking finance fields to deal with data overload and latency gaps with cutting-edge digital solutions.

We identified that insurers’ 30-day claim cycles cause 15% customer churn, lead to fraudulent claims draining 10-15% of their revenue, and even face difficulties in scaling usage-based models. We are into solving that with our AI and cloud-enabled solutions.

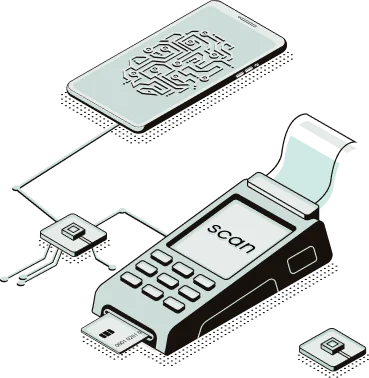

Neobanks are facing Customer Acquisition Cost (CAC) exceeding Lifetime Value (LTV) due to undifferentiated features, and payment tech needs to scale to support 1M+ TPS without fraud spikes. Not only that, 60% of fintechs fail due to poor API ecosystem integrations, and fraud losses are eating 7% of revenue in cross-border payments. We are here to help fintech startups with our emerging tech-enabled software solutions.

From legacy modernization to AI-driven innovation, we’re here to help you stay ahead in the financial race.

CONSULT OUR TRAILBLAZERFinancial institutions need partners who blend cutting-edge tech with domain expertise to turn challenges into growth. We deliver that by offering the mentioned services:

Finance management isn’t one-size-fits-all. Every industry faces unique challenges and complexities. We tailor our digital solutions to meet the specific financial needs of your industry, ensuring precision, efficiency, and compliance.

Financial services demand agility. Our solutions ensure that by equipping financial institutions with next-gen technologies like cloud computing, advanced analytics, and API-driven ecosystems to accelerate digital transformation and revenue growth. Here's why we are the best shot for revolutionizing your financial services:

Find answers to the most asked queries about our digital finance solutions to navigate your project with us confidently.

By integrating intelligent process automation (IPA), robotic process automation (RPA), and real-time data analytics, we enable financial organizations to reduce manual errors, cut costs, and improve decision-making, resulting in improved operational efficiency.

AI/ML enables financial institutions to make data-driven decisions by analyzing vast amounts of structured and unstructured data in real-time. This way AI/ML technology helps to enhance credit scoring, detect frauds, assess risks, improve customer segmentation, and optimize investment portfolios.

Yes, we provide API-based solutions that enable seamless integration with open banking platforms, fintech applications, and third-party financial services, like payment gateways, KYC verification services, fraud detection systems, and more. All these enable financial institutions to offer a unified, customer-centric banking experience.

We assist banks in modernizing their core banking systems by implementing cloud-native architectures, microservices-based development, and API-driven integrations. Our approach includes:

We leverage AI and API integration approaches to enable automation of financial reconciliation processes. We do this by:

We leverage AI, big data analytics, and real-time processing to optimize trading strategies. Along with that, we implement:

We provide AI-driven fraud detection solutions that use real-time transaction monitoring and behavioral analytics to identify fraudulent activities. Our solutions include: