How Much Does it Cost to Create a Trading App Like Robinhood?

- Mobile

- February 3, 2024

Stock trading app development demand has increased in recent times, owing to Fintech startups using it as a business opportunity to become a part of a multimillion-dollar global trading market, drawing inspiration from the successes of Robinhood and other similar trading apps, with millions of monthly active users. If you’re also exploring how to create a trading app, this blog post will guide you by providing insights into how stock trading app development works, market overview, development process, trading app development cost, future scope, and more.

Robinhood, the trading app launched in 2013, garnered appreciation and noteworthy investments within a few years. The venture offered commission-free trading for stocks and exchange-traded funds (ETFs). Their no brokerage fee attracted the younger generation and potential investors willing to invest in stocks and ETFs without paying brokerage fees.

Moreover, Robinhood has a user-friendly mobile app and intuitive interface that makes it easy for even novice investors to start trading. The trading app design, easy-to-navigate layout, robust features, and accessible design contributed to its success and eliminated complexity from the investment process.

Its success motivated other investors to put money into trading app development and facilitate similar services. However, not everyone was successful in comprehending their app design and development strategies. Many failed to build a similar app and ended up creating a less functional and hard-to-navigate application that brought losses instead of profits.

So what’s the strategy for building an app like Robinhood? Well, the process is lengthy and time-consuming, and you might have to cross-check a lot of factors before you put money into it. To assist you with your project, we’ve crafted a comprehensive step-by-step guide covering all aspects of stock trading app development, similar to Robinhood. Take a look at it to learn the process!

How do Stock Trading Apps Work?

Trading apps serve as a platform for investors and allow their users to buy and sell financial assets, including stocks, mutual funds, ETFs, cryptocurrencies, etc. These apps assist users with the entire process, from account setup to trading and executing orders.

In addition, they display real-time market data like stock prices, indices, and other relevant financial information. They offer technical analysis tools, charts, research reports, and portfolio management features to help investors make informed decisions.

Through the app, users can place various types of orders like market orders, limit orders, stop-loss orders, etc. These orders specify the price and quantity on which users can buy or sell assets.

However, the functionalities of online trading apps are wide and varied. You can develop them for various purposes and expand or limit their functionalities according to your targeted service, user base, and business requirements.

Market Analysis of Trading Apps Like Robinhood

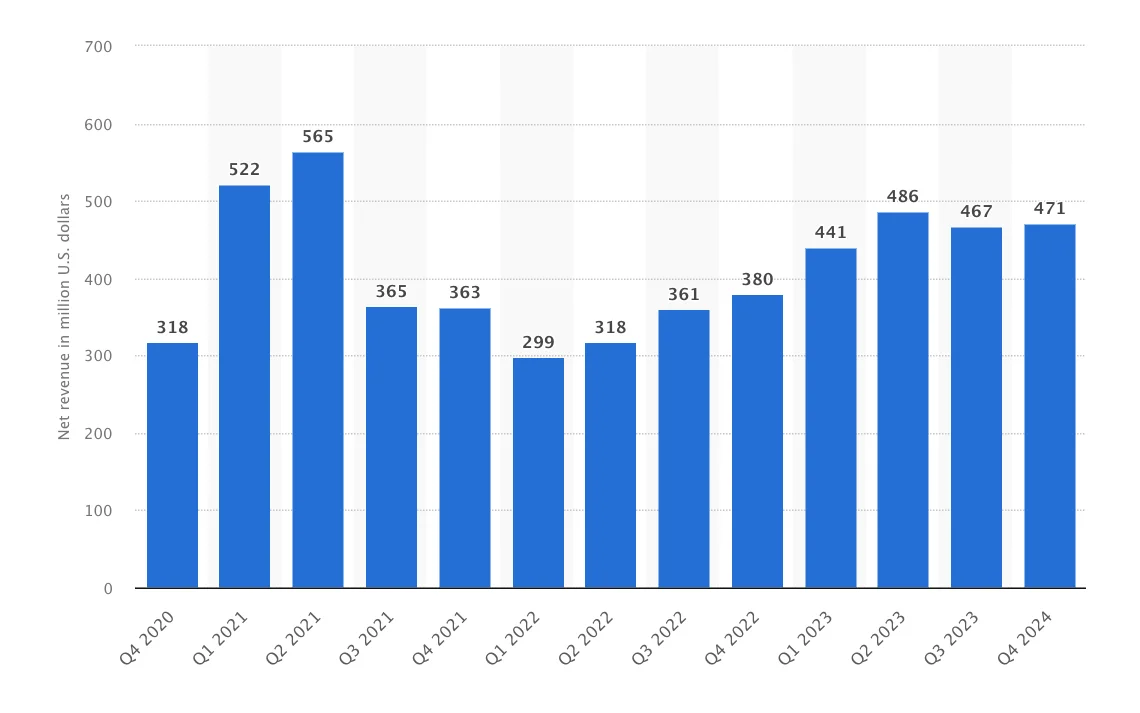

Robinhood acquired a total net revenue of $1.87 billion, marking a 37% year-over-year increase. It also recorded 10.9 million monthly active users.

The final quarter of 2023, contributed 471 million U.S. dollars to the total net revenue according to a report in Statistia

These stats display the market demand for fintech apps and their growth opportunities.

However, Robinhood alone is not enough to showcase the market potential. So here are other stats proving the success of trading platforms.

- In 2023, the market size of the global online trading platform stood at USD 9.55 billion. The number is forecasted to grow to USD 10.15 billion by 2024 and USD 16.71 billion by 2032.

- The market will exhibit a CAGR (compound annual growth rate) of 6.4% during the forecasted period of 2022 to 2030.

- After the launch of trading apps, even people with slight knowledge of trading could invest in stocks and other financial assets. These apps made investment accessible to a broader audience who couldn’t seek assistance from traditional brokerage services.

- The demand for customized trading platforms is increasing with each passing year. Non-profitable and government organizations are driving the demand forward and finding relevant solutions to meet it.

- At present, the market for trading applications is highly competitive, with both established financial institutions and startups vying for market share. Established broker banks have invested in trading app development and launched their apps to stay relevant.

What are the Must-have Features of Trading Apps?

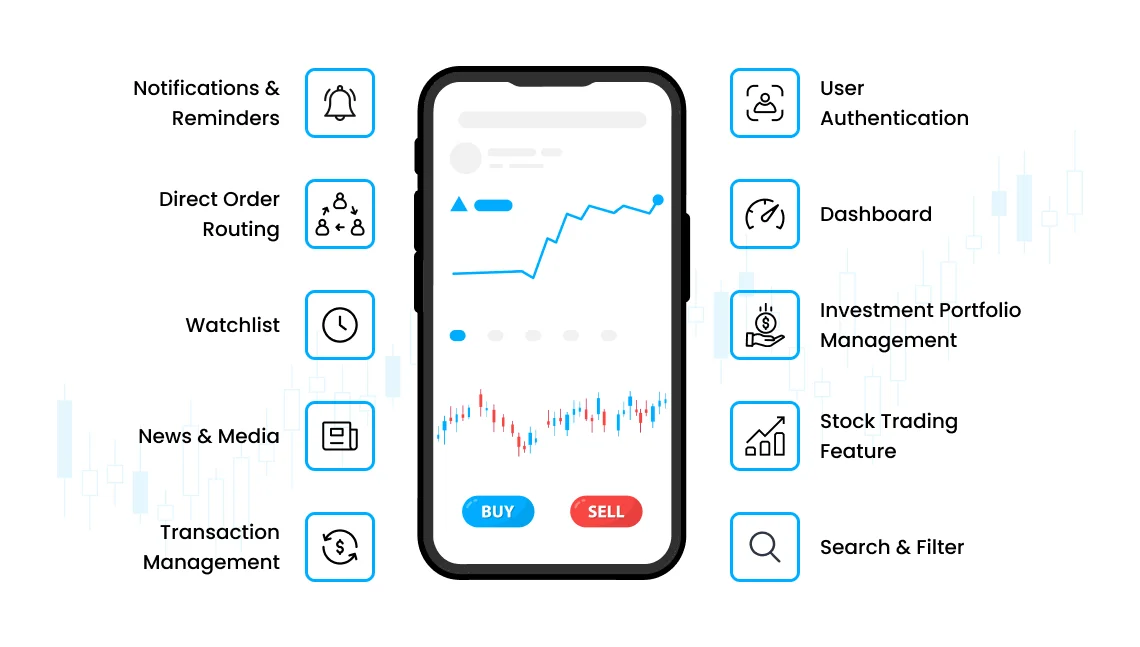

Stock trading apps have wide and varied functionalities tailored to meet user expectations and demand. Here’s a breakdown of the most useful features in trading apps, offering insights into their functionality to guide you in how to create a trading app.

User Authentication

Your trading app must offer easy and authenticated login. It should allow users to register using various options, including email ID, phone number, social media networking sites, biometrics username password, etc.

The authentication must involve government-approved trading procedures, rules, and regulations. It should enable users to follow these rules while creating and using their accounts.

Dashboard

The dashboard is an important feature, and you must hire skilled developers to create an informative and easy-to-access app dashboard. While using the app, your users must be able to reach the dashboard from the app homepage directly.

The dashboard design must intricately display essential details such as the watchlist, balance, holdings, charts, order status, user information, etc. Avoid adding unnecessary features and overloading the page with too much information. Keep it straightforward and to the point..

Investment Portfolio Management

The investment portfolio management feature enables users to create and manage their portfolios without the intervention of any broker or third-party agent. Users will be able to view and manage their holdings, transaction history, gains, losses, and overall portfolio performance.

Stock Trading Feature

It is a core functionality that your stock trading is bound to have. The stock trading feature enables users to trade stock and execute related tasks. The feature streamlines the trading process of stock holding, buying, and selling.

Source: Stock Market App

Search & Filter

The feature will simplify trading for investors. They can sort out things and analyze stocks and their trading history better after filtering unnecessary details from the ledger. Filtering and sorting will cut the time they invest in finding relevant details. You must ensure to keep it in your application.

Watchlist

Watchlist allows investors to add their favorite stocks to the wishlist to make future purchases. Through this, they can list out particular stocks, keep track of their progress and avoid searching individually for them.

News & Media

It is significant for traders to stay updated with current market events and ongoing events. Your app must have an integrated newsfeed to provide real-time trading news and market analysis from trusted authorities. The information will aid investors make an informed investment decision.

Transaction Management

You must keep features to manage transactions and integrate them with payment gateways to facilitate online payments. Safeguard this feature with best security practices and keep the information limited to users and administration.

Direct Order Routing

It is an advanced feature that gives suggestions on trading. An algorithm is attached to this feature that fetches details from various financial sources and provides tips accordingly. Investors can review these suggestions and implement the most suitable one to place the order.

Notifications & Reminders

Push notifications and reminders are real-time alerts that keep traders informed of the latest updates. They give information regarding dividend announcements, earning track, news updates, account activity, stock price fluctuation (rise or drop), and many more.

However, keep this feature organized so it can avoid randomly sending notifications. It must be able to filter and send important information to users.

Apart from it, user registration, real-time data, watchlist, charts, transaction history and statements, research tools, customer support, etc., are some notable features of stock trading platforms.

How to Create a Stock Trading App Like Robinhood?

With its intuitive interface and commission-free trading model, Robinhood has revolutionized the way individuals approach stock trading. If you are considering stock trading app development, here’s a comprehensive guide on how to make a stock trading app like Robinhood, covering essential steps and considerations for your eTrading app development journey.

Step-by-Step Guide To Develop Stock Trading App Like Robinhood

1. Conduct Market Research To Understand Your Target Audience

Conduct detailed market research to identify your target audience and their needs, perspectives, and behavior. Also, research competitors and study their strategies, know more about existing stock trading apps, and understand ongoing and upcoming market trends, ups and downs, and potential growth opportunities.

At last, validate your app idea with potential users and investors to cross-verify market demands and conditions.

2. Define the Technical Objectives of Your Application

Define project objectives, including core features, app layout, targeted audience, type of trading app, user requirements, technical specification, length, budget, etc. Plan the further process and choose a development approach while prioritizing important objectives.

3. Decide on Design and Development Approach

Comprehend your project in-depth, and create wireframes and prototypes to visualize the app’s user interface (UI) and user experience. You can take the reference of Robinhood tech stack

Decide technology stack, including programming language, frameworks, third-party APIs, and libraries needed for specific functionalities. At last, iterate the design based on feedback and usability testing.

4. Onboard the Best-Fit Trading App Development Team

Trading app development is not a layman’s work. It involves back-end and front-end development, API integration, security measures implementation, server setup, and many other complex tasks.

Despite having technical skills, you can’t do them alone. You should hire dedicated mobile app developers to work on the project. Also, while hiring, ensure to have an expert team who is well-versed in development approaches and practices.

5. Conduct Quality Testing and Publish Your App

After developing the trading app, conduct rigorous testing to identify technical errors, malicious codes, bugs, broken links, and other security threats. Fix these threats and protect the app using proven security practices. Then publish the app on app stores like Google Play Store and Apple App Store.

6. Ensure App’s Post-launch Efficiency with Maintenance and Technical Support

Compile with government laws and regulations of trading app launching and closely watch its performance and user feedback after launch. Along with it, regularly update the app, fix bugs, add new features, and optimize app speed and performance.

Also, stay updated with the latest changes in financial markets and regulations to shape your app accordingly. Follow the process to obtain desired results.

How Much Does It Cost to Build a Stock Trading App Like Robinhood?

The cost of developing a trading app like Robinhood can vary from $50,000 to $300,000 (or even more), depending on various factors, especially the complexity of the app.

Here are some factors that would affect the actual cost of Robinhood-like stock trading application development:

- Trading app design

- Project tech stack and app type

- Front-end and backend infrastructure

- App features and functionalities

- Launching platform

- Development complexities, technical support, and maintenance

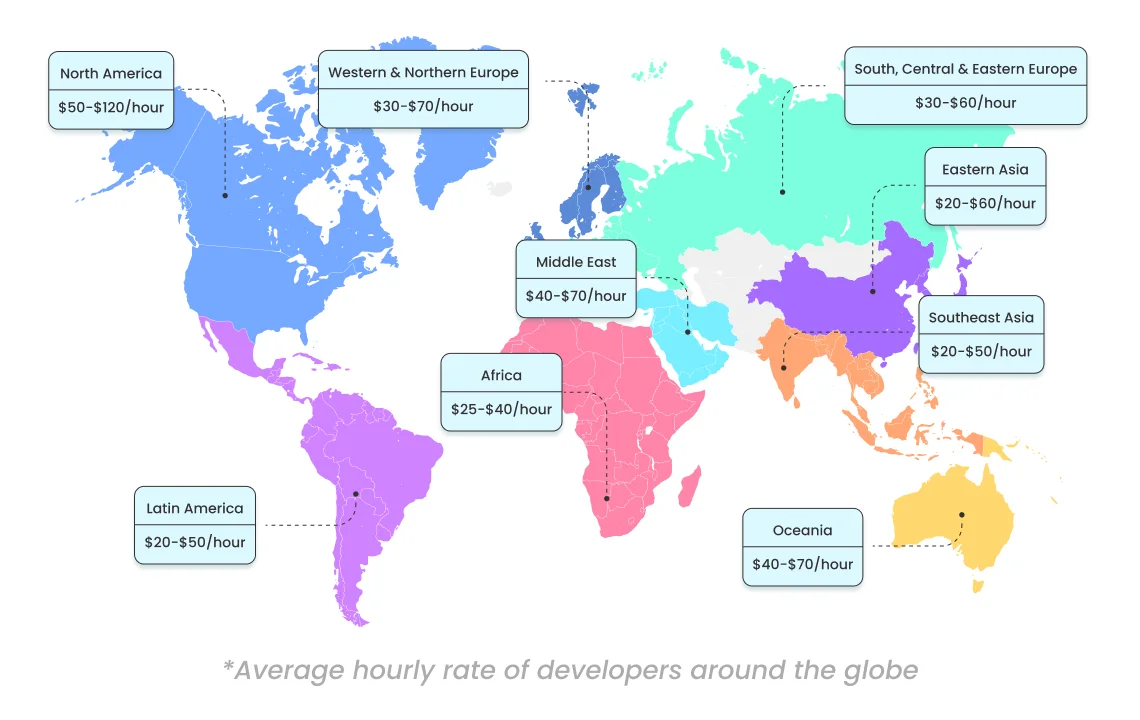

- Number of hired resources and their experience, skillset, and location

Want to know how much it costs to build a mobile app? Here’s a comprehensive guide and the key factors that influence the cost of mobile app development.

You can opt for an hourly-based engagement model and pay developers accordingly. The price breakdown for different locations is included in the image below.

Note: Prices mentioned in the image are subject to variations as per market demand and fluctuation.

For exact estimation, you can contact a mobile app development company like MindInventory and discuss your project requirements. The expert team will give you the budget estimation and suggest an engagement model as well.

How Does Stock Trading App Make Money?

While many stock trading apps provide commission-free trading, others still generate revenue through commissions on each trade investors execute.

Robinhood, however, stands out as one of the pioneers of commission-free trading. Its no-commission fee model has attracted potential and young investors seeking to earn money through trading and investments. Additionally, Robinhood does not charge for opening or maintaining accounts, and investors can transfer funds without incurring any fees.

Now, you must be thinking, if Robinhood is free to use, then how does it make money? Well, the fintech company follows various other revenue stream models for generating revenues and profit. Below-mentioned models are the most notable ones.

Payment for Order Flow

Payment for Order Flow is general practice in the brokerage industry that fintech apps use to make money. In the PFOF model, trading applications sell their users’ trade orders to market makers on behalf of their users.

These market makers pay the brokerage for the order flow to trading apps. In return, market makers execute this trade and earn through small spreads on the bid and ask prices of the traded securities.

Both stock trading apps and market makers get a small amount through the PFOF model, but if they execute many orders, they get a significant amount and generate higher revenues.

Premium Services or Subscriptions

Fintech apps offer premium services or subscriptions at substantial rates and charge their users monthly and annually. These premium services offer extra benefits, investment tools, research reports, market data, investment tips, and margin investment opportunities at low prices.

Interest on Securities and Margin Loans

Trading apps like Robinhood take interest by giving securities and margin loans. They charge a substantial interest rate on margin loans ranging above $1000. They earn by lending securities to their counterparties.

Revenue Generation From Unused Amount

Trading platforms use the money kept in investors’ accounts and deposit it in saving banks. They earn through the interest that adds to their revenues. However, the amount is small as compared to other revenue models.

Other Revenue Models

Trading platforms also partner with other financial services, broker firms, or companies and charge commissions for user referrals. They accept sponsorships, sell market data, and promote third-party services to increase revenues.

How to Ensure Trading App Security with Best Practices?

Trading apps involve high-value financial transactions and stock holdings of investors. These properties are highly vulnerable to cyber threats, theft, and hacking. You must stay careful while handling sensitive financial data and transactions. Also, follow these security practices during trading application development to keep the safety hazards away.

Effective Security Practices

You should implement common security practices to prevent the app from vulnerabilities like SQL injection, Cross-Site Scripting (XSS), and Cross-Site Request Forgery (CSRF). Apart from it, update the codebase to patch vulnerable spaces.

Data Encryption

Data Encryption implements algorithms that transfer data into codes using protocols like HTTPS. These codes are secure and have limited exposure only to the intended receiver. It protects sensitive information from interception during communication between the server and the app. It also encrypts sensitive data in the database to prevent unauthorized access and breach of data.

Two Factor Authentication

Just a simple login with a username and password is not enough to keep the trading app away from cyber attacks. You must integrate a feature for two-factor authentication and enable investors to add their phone number, email address, fingerprints, and Face ID. This practice will ensure uptight security during communication, trading, and transactions.

User Data Protection

Store essential user data and implement data minimization to avoid excess storage and data leaks. Comply with data protection regulations, including GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) to protect user privacy. Along with it, set up robust monitoring and logging to detect and respond to potential security concerns promptly.

Role-Based Access Control

Role-Based Access Control is a security practice that helps limit access to certain users within the system based on the roles assigned to individual users. In the RBAC system, access permission is granted according to the user’s defined role, and full access to everyone is restricted in this approach. The practice is a structured and scalable way to manage access rights and permissions within the app.

Regular Security Audits

Conduct regular penetration testing and security audits to identify and address potential weaknesses in your app’s infrastructure and code. Frequent security audits will help you avoid cyber attacks, bugs, hacking, phishing, data leaks, and unauthorized access.

Implement Secure Session Management

Use secure session management practices to ensure smooth operations and avoid forgery and theft. Take the support of session tokens, setting session timeouts and expiring inactive sessions while managing operations and app activities.

Current & Future Scope of the Trading Industry

The number of traders wishing to earn from investments is growing each day, and it will continue to rise in the future. To meet the market demand, the trading industry is adapting innovation and technical advancements. Here are a few glimpses of current and future trends:

- The rise of cryptocurrencies has generated demand for crypto trading platforms, and they will gain mainstream acceptance very early.

- Fractional share investing enables investors to buy share portions with limited funds. Platforms offering fractional share trading are becoming popular among retail investors.

- Trading platforms have launched robo-advisors to help investors create and manage investment portfolios based on their profiles, budget, and financial goals.

- Social trading platforms allow users to follow the trades of successful investors. The approach combines social networking with investments and helps beginners make better decisions.

- Fintech companies will also leverage Artificial Intelligence and data analytics to develop sophisticated trading algorithms and strategies.

- Decentralized finance (DeFi) space, web 3.0, and blockchain technology will disrupt traditional finance and create opportunities for decentralized trading platforms and advanced financial products.

- Trading apps will gamify investments using virtual reality and introduce virtual trading competitions, interactive features, and rewards.

- Fintech apps providing access to international markets and emerging economies will attract investors looking to diversify their portfolios and capitalize on global growth opportunities.

To know more about it, read Top FinTech Trends That Will Take Place In 2023 and Beyond.

How Can MindInventory Help You Build A Trading App Like Robinhood?

Summarizing it all, investment in trading app development offers numerous advantages, ranging from diversified revenue streams to enhanced brand recognition. Along with it, a well-developed trading app can be a game-changer for your business and financial institutions. However, you need to hire a reliable trading app development company to hand over the responsibility.

MindInventory can help you develop a trading app by providing expertise, resources, and a structured development process. We are a reputed fintech solutions provider assisting business owners in building and launching a trading app. We have a skilled design and development team to create visually appealing interfaces, integrate advanced functionalities, and develop robust backend infrastructure.

Our experts are well-versed in implementing robust security measures to protect user data, financial transactions, and sensitive information. Our team also helps you with game publishing and provides dedicated support and maintenance services to ensure seamless operations.

Contact the MindInventory expert team to develop your trading app with the industry-best strategies.

FAQ on Trading App Development

Stock trading apps enable users to buy, sell and manage financial instruments. Their specific functionalities include account creation, portfolio management, stock trading, order placement, market analysis, fundamental analysis, fractional share investments, paper trading, transactions, and many more.

To protect your data, choose reputable apps, enable two-factor authentication, secure your device, avoid login from public wifi, use secure payment methods, and protect personal information. Along with these, avoid sharing any financial information on unauthorized calls or public forums.

The development of a trading app, with varying complexity, typically takes anywhere from 800 to 1500+ hours. Apart from app complexity, the estimated timeframe would vary due to factors like features, development team size, hiring model, choice of app platform (Android, iOS, or cross-platform), and more.