How to Develop a Secure Mobile Banking App?

- Mobile

- October 16, 2018

The banking and financial system has undergone a phenomenal revolution with the transfer of upgraded and advanced technologies.

The advent of innovative techniques such as the Internet of Things, the Blockchain technology, introduction of the various cryptocurrencies, the Fintech and digital transformation etc. have all contributed their role in this escalation.

Today people have also opted for smart banking solutions. They no longer have to visit their branch for availing the different kinds of banking services like opening an account, applying for any particular loan, depositing, or withdrawal of money, and so on.

In fact, slowly and gradually, most of the major financial institutions around the world have already started offering internet banking and now mobile banking services to their customers.

According to Gartner, about 25% of the top 50 global banks have the native mobile banking facilities.

Let’s move on to some other interesting figures and stats. According to a research, it is expected that the number of customers availing banking services through mobile application will exceed to 1.75 billion by the year 2019. That is seriously huge figure.

The mobile banking is not only confined to developed nations, but developing countries like India and China are boosting their economies via mobile banking.

And as more and more individuals are opening their accounts and getting associated with banking system, the future of mobile app banking seems to be bright and lucrative.

Read also: The Important Finance Industries Disrupted by the Fintech App Development

The Benefits of Mobile Banking App

McKinsey pointed out that the conventional banking system is growing at a slow pace with over 37% population using it, while the mobile app banking has reached out to 50% users at the same time.

Therefore, there are various reasons why customers are preferably switching over to mobile banking apps:

24×7 Access of Online Banking

One of the key reasons why people are moving towards the smart banking solutions is because of the 24×7 accessibility to all the online services.

The traditional banks and ATMs are not available everywhere and you cannot get their services all round the clock.

One App, Many Solutions

The mobile banking app is your one stop shop to avail all banking solutions.

You can open different types of accounts and apply for various schemes, transfer money to someone, receive money, deposit fund and apply for different loans, check your balance instantly, and also get support from the customer service executive in case of any query or issue.

Time Saving and Cost Effective

Mobile banking obviously saves a lot of time as you don’t have to visit the branch every time for availing the service.

You can do it everywhere. Moreover, it is cost-effective as banks do not charge anything extra for offering the solutions.

Easy and Faster Transactions

You can conduct the financial transactions with just a few taps on the screen after choosing the relevant options. It is relatively much easier and faster not taking more than just a few seconds.

So, you need to remember that merely providing the online services will not suffice your profitability, but it’s time to consider on creating a banking app. Now, what goes into building a successful mobile banking app? Let’s have a discussion:

Getting Familiar with the Target Audience

Its fine that you have made up your mind finally that you want to get a banking app developed. But just don’t get exaggerated and dive straightaway into the development process.

It would be better to take one step at a time. So, first start with defining the target audience. It is imperative to get familiar with who your target audience is.

In today’s scenario, the circumference of mobile banking users is not just limited to mobile freaks, gadget lovers, and tech-savvy people who remain online in most hours of the day.

There are other millennials also belonging to different age groups (of above 18+) who seem to be much interested in using the banking apps.

The Security Should be on the Top

One of the prime reasons why we chose security over the app feature is because it is paramount and should be on the top of priority list above everything else.

It must be kept in mind that you are developing a banking app, where N numbers of users will be precisely securing their utter confidential data such as ATM card details, credit card information and the online passbook.

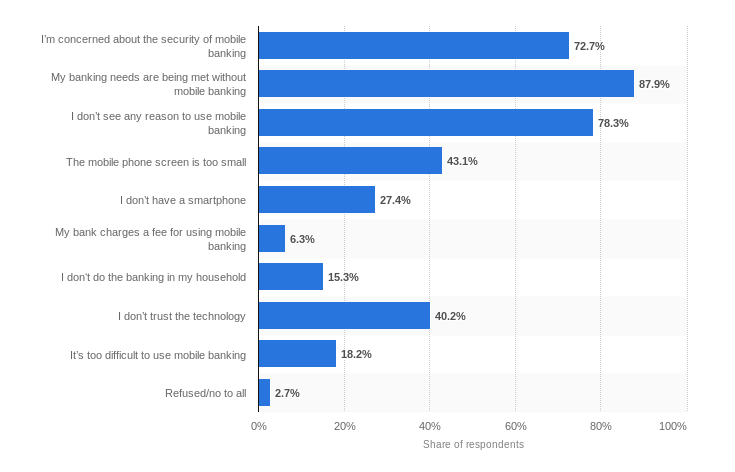

Another noteworthy aspect is that the customers are a bit apprehensive and concerned about sharing the secret details, especially if they are the first-time user.

In fact, Statista indicated that 72.7% Americans didn’t want to go for mobile banking app because they are worried about security.

Therefore, you have to eliminate this concern factor by providing them a robustly secured app, which cannot be hacked easily. Therefore, you need to take these important steps when implementing the security feature in your app.

- It is highly recommended that you should necessarily access and examine the app security terms and conditions very thoroughly. It must be ensured that they keep a strict vigilance and control on how the mobile application is getting operated on the network.

- The next vital step is configuration of the application servers. You need to make sure that the emails, which have been sent to the ‘Spam Category’ and have been tagged as phishing emails are not forwarded to the mobile devices.

- You must mandatorily implement the latest trend and advanced technology accessible. Make it a point to upgrade the banking app at regular intervals. Send notifications regarding this to the users.

- In order to refrain and prevent a illegal hacker from entering into the unprotected data premises, you should integrate an encryption program for the storage cards.

- It is a right step to develop a tool that can check the strength of the password. Ask users to enter strong passwords that are difficult to crack. In usual cases, the strong password length varies from six to ten characters. But since it is mobile banking, minimum length of password should be not less than 12 characters. Also, it should be a mixture of small and large caps, numerical and special characters.

- You should keep sending regular emails and SMSs alerting users not to get allured by fraud calls, emails and fake prizes and rewards asking them to share their bank and card details.

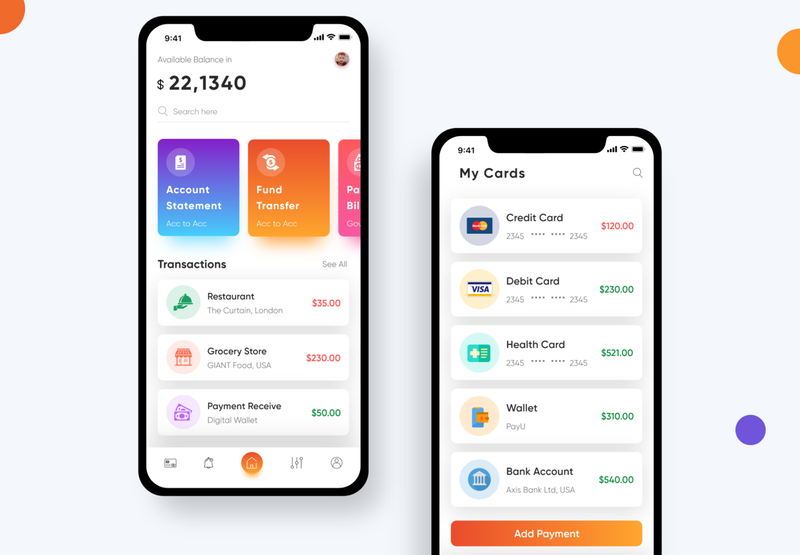

The Features of Mobile Banking App

Now that we have talked about how to boost up the security, we can concentrate on incorporating the key features in mobile app banking.

Login or Registration Page

Like most of the mobile applications, the banking and financial app also compulsorily need a login or registration page where the users can sign-in into the app using their email-id and phone numbers.

Once the user enters both the information, you need to send a verification link over email to activate the account. You can also send an OTP on phone as well.

Creating the User Profile

The user profile contains full information of the user including his name, email id, phone number, bank account number, bank branch, IFSC code.

He can access his details and conduct m-banking either by entering the password or the Pin number.

Transaction History or Online Passbook

Nowadays, most of the banks offer their clients the facility of accessing their passbook or the transaction history through their app.

The transaction details should be displayed in a simplified manner so that it becomes easier for the user to understand which amount has been credited or debited from his account.

You can also look to provide with the fund management tool such as budgeting tools, which offer tips on how to control and manage your earnings.

Host of Other Services

There are some other host of services that you should include in the banking app. It includes transfer of money through various methods such as net banking or IMPS.

In addition, you can add a section where the users can pay their bills online for mobile phones and electricity, book flight railway or movie tickets, pay their shopping bills and much more.

Gone are the days when applying for any loan was a daunting task. With mobile apps, this process can be completed with a few steps.

Apart from that you can also make payment for different insurance premium, operate your demat account for sharing trading etc.

Push Notifications

It is crucial to include the push notification feature in your banking application so that you can send alerts to the customers in case of debit or credit in the account.

Moreover, you should also make your customers cautious about fake calls indicating lottery prize, spam, and phishing.

Furthermore, you can also send discounts and attractive offers on purchase using the credit or debit card.

Read also: Push Notifications Can Re-Engage Your Lost Customers and Avoid App Churning

Accessing the Account Offline

The banks also need to provide the offline services besides the online solutions.

You can integrate this feature and benefit in combination with the geo-location tools so that they access their account even if there is no internet connectivity.

Customer Support

Customer support is a necessary asset to add in the mobile banking app.

The customers can contact the bank customer care executives in case they want to know some information about their account details or any other service that they want to avail.

Geo-location Facility

These days’ banks also offer the geo-location facility, which helps the users in finding the nearest branch or ATM of that bank.

Read also: Benefits of Having Geolocation in Your Mobile App

The Simple and Sophisticated App Design

You want to attract more and more users into your banking app; isn’t? Here’s a straightforward mantra; just keep the app design simple without comprising with sophistication:

- The first option is choosing an intuitive navigation with selection of minimalistic key functions.

- It is appreciable if you are providing the shortcut keys for important functions.

- It is not necessary to include password option for every service. You can avoid it while user wants to check his balance.

- Consider the different kinds of gestures during a prototype including the swipe, pinch, rotate etc.

- Testing of the app design also becomes pivotal same as when testing the banking app after developing it.

The Cost of Banking App Development

According to an estimate it has been found that, the world’s top 15 leading banks have already spent $80 million on developing about 606 mobile banking apps.

So, if we calculate the average, it’s coming to figure around $132,000. The figure may seem to be high but you don’t have to get concerned. The cost differences from nation to nation and the App Development Company you choose.

Apart from that there are various other factors deciding the cost of the project such as platform, number of features, app design and others.

Conclusion

The mobile banking has brought a drastic change in the way people used to avail the services. It has grown tremendously reaching out to different sections of the people. They can receive a number of benefits and also make payments in real-time without any hassle.

The banks are continuously working on to enhance and improve the security and also trying to add more facilities in the existing list.

If you are looking for an adept mobile app development company to develop your mobile banking application at most affordable rates, then do get touch with us.

FAQs About Mobile Banking App

The cost of developing a mobile banking app depends on many factors like the location of a developer number of features, and app design. The approximate cost for a mobile banking app would range around $50k -$80k.

There are many factors to consider for figuring out how long does it take to develop a mobile banking app like the app platform, the complexity of the design, features and functions, testing, etc.

There are many ways to hire a developer for a mobile banking app like searching on Google, Clutch, LinkedIn, Upwork, and AppFutura. But, the most trusted way is to hire an app development company like Mindinventory.