Top FinTech Trends that Will Take Place In 2025

- Business

- June 6, 2023

Welcome to the calculative yet exciting world of Financial Technology, which we also know as FinTech! These days, FinTech is encountering rapid positive change. As per the study of ExpertMarketResearch, the FinTech market was last valued at $194.1 billion in 2022 and is projected to reach $492.81 billion by 2028 at a CAGR of 16.8% during the forecast period of 2023-2028.

With the continuous evolution of the FinTech industry, it becomes essential to stay up-to-date with the latest FinTech trends and developments.

From mobile payments and online banking to online stock marketing investments, and above all, getting a worry-free, super secure payment transaction backed by Blockchain, the FinTech industry has been through many evolutions, and still, it’s on its way to evolve more! Progress in this industry is implied to help banks, financial institutions, and users who opt for their services to abstain from overspending, navigate risks, and usually deal with their finances conveniently.

One of the worthiest transformations has been the introduction of new advancements in FinTech services and products designed for particular functions inside the financial ecosystem, like Reg-tech, InsurTech, and robo-advising.

This guide covers everything you need to know, whether you’re a FinTech entrepreneur, investor, or interested in adding up your knowledge about the future of financial technology; simply, it’s specifically designed for you!

But before we dive in to know the top FinTech trends to explore in 2025, let’s reflect on what FinTech is!

What is FinTech?

FinTech is not an acronym but definitely a short-term for financial technology, making use of compatible industry-leading technologies to innovate and improve financial services. It encompasses a wide array of use cases, including mobile banking, quick digital payments, peer-to-peer lending/borrowing, new credit options, robo-advisory, and many other services.

Whether implemented in combination or individually, FinTech solutions can make a business more helpful to be able to proactively interact with employees, clients, or suppliers. Additionally, FinTech solutions can organize business operations by combining many software products into one completely digital ERP solution, which we also know as B2B SaaS integration.

Online selling of products and services, receiving digital payments in any form, and from anywhere that is feasible and legal for every party involved, which is the reality made by FinTech.

Indeed, it has disrupted the way of managing finances by enabling consumers with highly accessible, cost-effective, convenient, secure, and seamless digital financial services.

Top FinTech Trends to Encounter in 2025

The list of FinTech trends we mentioned below may not necessarily be new, but definitely, the ongoing ones and the pace of transformation or adoption level are notable. Let’s see what FinTech trends to watch out for in 2025!

Digital-Only Banking

When a bank virtually provides P2P transfers, contactless MasterCard alongside fees-free transactions, global payments, and an opportunity to purchase and exchange Ethereum, Bitcoin, and other cryptocurrencies, the financial sector leans its attention.

Digital-only banks are truly beneficial as nobody needs to spend a moment visiting any bank physically, no requirements to do tedious paperwork and no queues for testing your patience. Therefore, they are developing in revenues and numbers worldwide.

Want to get the motivation to build your digital-only banking solution?

If we see the statistics of the USA only, then around 65.3% of US citizens were reported using digital banking services on a regular basis. In fact, 80% of US millennials and 48.5% of baby boomers have been surveyed using digital banking in 2022.

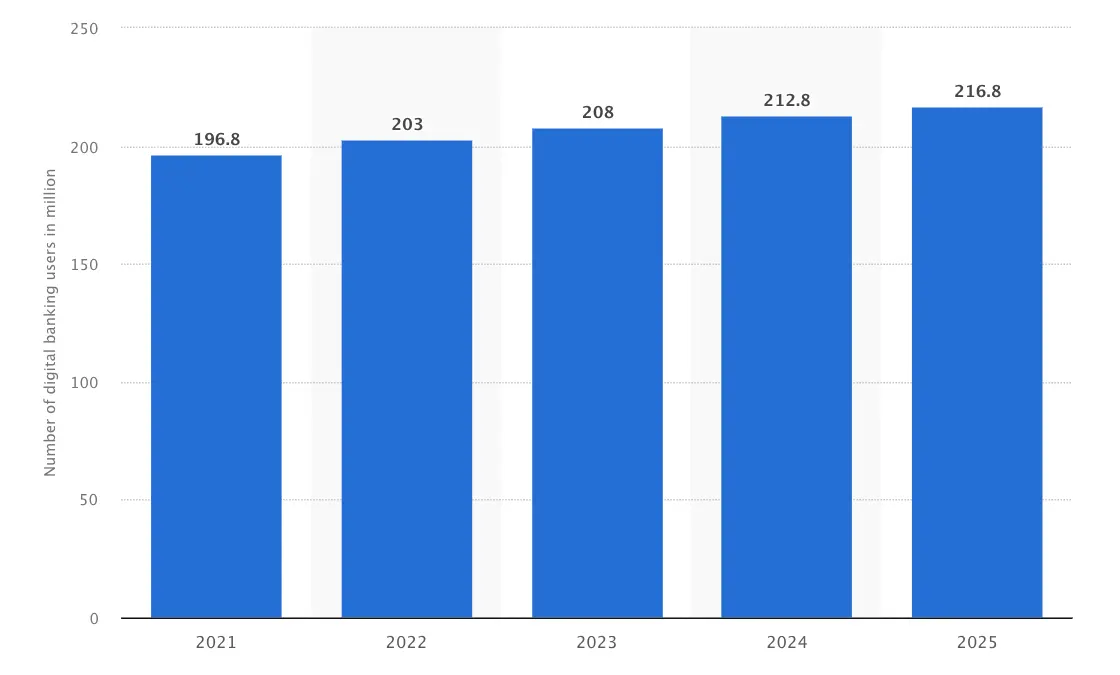

Also, digital banking users in the US are projected to reach 216.8 million by 2025.

And at a global level, the rate for the same is expected to reach 3.6 billion by 2024.

Their motivation for these citizens to use digital banking includes higher interest rates, no geographical constraints to do banking, lower fund transfer wages, faster bill payment processes, real-time analytics, and quick balance review with seamless access to the bank transfer statements any time, for any duration.

When bank consumers get so many benefits from the comfort of their homes or regardless of their geographical location, your bank is just a step away from consulting an IT professional to discuss your specific digital banking solution!

Open Banking

This is another noteworthy technology that brings banks and financial technology together, allowing data networking across many institutions. Directly associated with the Second Payment Services Directive (PSD2), it makes banks understand their info in a standardized, secure form for data to be shared digitally among genuine companies.

Open banking offers more controls and flexibility to FinTech users over their finances with the enablement to securely transfer financial information to third parties. It unlocks conveniences for consumers and new opportunities for commercials to enter new markets, implement innovative online services, and boost platform reliability through data exchange.

So, any bank, payment-centric companies, financial institutes, FinTech employees, banking institutions, API industry figures, clients, and even underserved communities can leverage Open Banking solutions for better financial operational efficiency. It also offers governance over financial data storage, a quick fund transfer facility to the recipients, and an option to make data available to the third-parties when needed.

With all these offerings, the adoption rate of open banking is increasing continuously, side by side with mobile payment adoption. To be precise, in May 2022, the figures for open banking adoption rate had crossed 6 million in a sorter span, which was surveyed 5 million in the final quarter of 2021 (Nov’21 to Feb 22), a serious 10-11% increase in the digitally enabled active users compared to March 2021, which was around 3-4%. Intriguing, right?

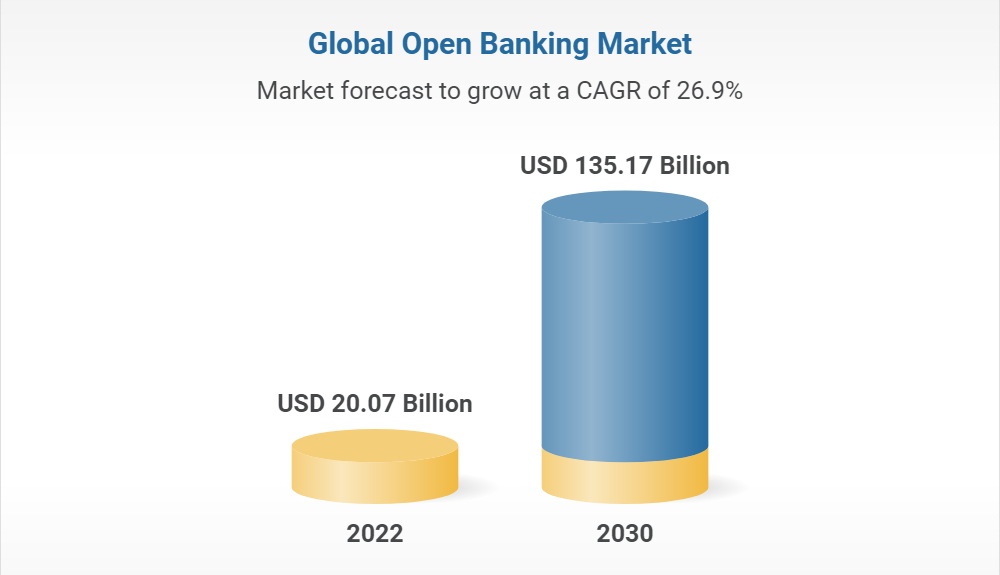

Hence, the global open banking market has been projected to reach $135.17 billion by 2030 at a CAGR of 26.9% for the duration of 2022-2030.

Indeed, open banking is on a mission to revolutionize approaches to managing finances with total transparency, governance, and enablement to selection.

Neobanking 2.0

With 77 challenger banks in Europe, and 64 and 54 challenger banks in North America and Latin America, respectively, the industry is getting saturated, having virtual options to branch-based banking that enable digital account opening without monthly fees. Competition is causing a demand for distinguishing among Neobanks.

Neobanks are the ones that operate digitally entirely with no offline presence. They offer all those services that traditional banks offer, like saving accounts, debit/credit cards, and loans, but all through mobile apps or websites, just the way PayTM bank operates.

From apps focused on financial recommendations and credit-building to niche-focused platforms – the next-gen digital-only banks are offering more than just debit cards and basic checking. This trend’s part will arise from non-FinTech organizations having a settled client or employee base that can get benefitted from banking services.

Big economy organizations can provide employee banking that deducts withholdings, gets wages, and permits advances depending on earnings history.

Moreover, business cost-handling tool providers are introducing total business banking platforms that incorporate credit lines for cash flow, deposit accounts, and corporate cards.

That’s the reason why the transaction rate in the Neobanking segment is expected to rise to $4.53tn by 2023 and $8.86tn by 2027 at a CAGR of 18.25%.

Biometric Security Systems

Mobile banking and other digital financial services have become popular as they are at one’s fingertips. It is not just a great accomplishment but also raises many security-related queries as cybercrime is increasing every day.

Digital services are all about conveniences and unlocking personalization with account authentications. But that also opens a gateway to cyberattacks extensively impacting financial institutions, which has gained an increase of 61% in 2022 (for the phishing attack specifically). This leads to multi-factor authentication along with biometrics.

Hence, every FinTech company should take all necessary security measures, and the biometric system is the greatest way of bringing security to a further level. In fact, biometric authentication is fortifying bank security – here’s how!

It offers users the confidence that their information is safeguarded. Nevertheless, at present, the biometrics market is experiencing massive changes under certain circumstances.

Biometric sensors that include physical contact are predicted to drop in popularity. Despite the entire development in the use of biometric technology for verifying identities, contactless solutions will take over the market of the touch-based fingerprint reader.

If we see the statistics, then:

- Around 61% of FinTech solution users prefer biometrics over typing passwords;

- Around 70% think of biometrics as the faster solution;

- Around 80% are likely to use fingerprint or facial recognition for unlocking their online banking apps;

- As there are still many banks that haven’t implemented biometrics yet in their apps, it might make them lose around 50% of their consumers due to that.

On average, a person could have around 100 different passwords, which leads to four out of five forgetting passwords within 90 days.

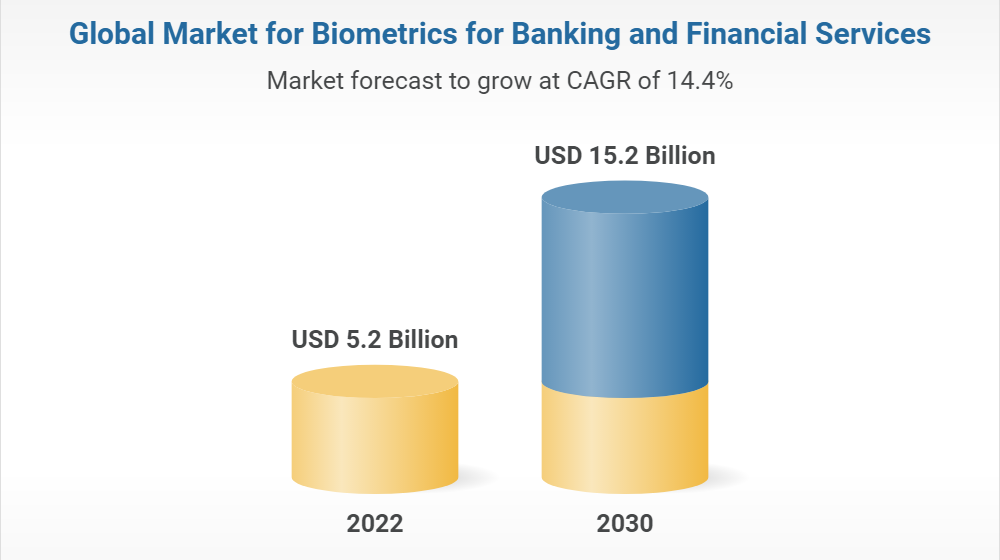

Hence, biometrics for banking and financial services is in trend, with an expected market size to grow to $15.2 billion by 2030 at a CAGR of 14.4%.

Artificial Intelligence

Since bank revenues have been surpassing the countries’ incomes, undoubtedly, AI is the next in line to be adopted. These days, banks are fine-tuning their AI solution tactics, resulting in their greater acceptance of AI in FinTech.

According to Autonomous Research, around 22% of Financial service cost reduction is expected by 2030 with the use of AI, resulting in a total saving of $1 trillion. Nevertheless, the way toward this outlook can be difficult. Unlike other global employers, banks don’t have a lot of AI-skilled experts.

Being capable of working with unstructured information, AI is well-balanced to manage the rising cybercrime incidents and financial fraudulence threats.

Artificial Intelligence is already popular, having the most efficient client service software using some intelligent features, like predictive analytics, chatbots, robo-advisors, and fraud detection. FinTech institutions won’t be an exception, enabling quicker transactions and providing clients with the feasibility they require. Hence, AI in FinTech is projected to grow to $61.30 billion by 2031 at a CAGR of 22.5%.

Autonomous Finance

For FinTech applications, autonomous finance is the prime building block. It remodels consumers’ way of interacting with money, becoming their service of choice, especially because of its advantages.

FinTech’s benefits lay the ground for more growth like autonomous finance. It emerges around the concept of self-driving funds. Not just the technology assists clients in making immediate decisions regarding their money, such as how to approve a loan at more reasonable rates of interest, where to invest the money, or what to do with an overdrawn account, along with performing all these jobs for them.

Autonomous finance began with robo-advisors incorporated with software-based financial strategies and mutual funds handling. Then, it emerged as an automotive-saving app and thus into credit card debt handling solutions, like the ones that also assist with student loans. We’ll know more about it in the latter section.

Autonomous finance utilizes the power of machine learning and artificial intelligence to handle users’ funds.

It also has potential as per different office-level use cases:

Back-office use cases

- Virtual assistant processing financial transactions

- Cloud-based financial analytics

Middle-office use cases

- Blockchain-enabled audit-ready automated clearance of financial book

- ML-powered identification and organization of financial data coming from various sources in bulk with accuracy.

Front-office use cases

- Predictive financial analytics to effectively plan out future finances and make informed decisions intelligently

At last, such apps assess the available options algorithmically and help a user enjoy the most beneficial ones.

Robo-Advisors

Who doesn’t like to get advice when opting for anything to know whether to invest in it or not, specifically in terms of finance? With the power of artificial intelligence and data pool, Robo-advisors are becoming the strength not only for financial managers and investment experts but also for those just getting started.

The robo-advisor market size was valued at $5.22 billion in 2022 and is forecasted to reach $41.83 billion by 2030 at a CAGR of 29.7%.

Relying on the AI data analysis algorithm, Robo-advisors can do:

- Analyze financial data at scale;

- Make decisions based on current changes quicker than human advisors;

- Give users (investors) the best investment advice to meet their criteria.

With technology getting more advanced, there’s yet more to see in trend in the latter years.

Blockchain Technology

Blockchain technology has been amusing tech-savvy users with its transparency, immutability, and top-notch security features, since its proliferation. It is not just a new technology but also a new philosophy of decentralized finance that concentrates on reducing centralized procedures.

As per the GrandViewResearch, the incorporation of blockchain technology with the digital financial services segment was surveyed dominating its global market size with a 37% share of global revenue, which was valued at $10B in 2022. If we are precise about it, the FinTech Blockchain Market is projected to reach $36.04 billion by 2028 at a CAGR of 59.9%.

By now, Blockchain technology has inspired the development of different online peer-to-peer financial platforms that allow monetary interactions to take place in a more decentralized manner. A distributed ledger technology that can improve current procedures and systems. Banks are already using Blockchain technology with the hope of reducing expenses and enhancing internal procedures.

The rise of blockchain technology has brought two important financial applications: Decentralized Finance (DeFi) and Cryptocurrency.

The market size of the DeFi solution was valued at $13.61 billion in 2022 and is expected to see growth at a CAGR of 46.0% during the forecast period of 2023-2030. And there’s no doubt that the United States comes first for the adoption of DeFi solutions.

Decentralized Finance eliminates intermediary regulation bodies and gives all transaction control to the hands of users. Total control with transparency and security. Then why not adopt it?

The revolutionary currency that has revolutionized the way of trading, cryptocurrency backed by blockchain, is becoming more mainstream, especially after the rise of NFT marketplaces.

In short, it can be said that blockchain technology is the future driver of the FinTech segment.

Reg-Tech

The financial industry is a regulated sector, and FinTech innovations need a simultaneous growth of RegTech. This indicates new tech solutions that enhance and organize regulatory procedures. RegTech has evolved regarding the highest institutional demand that has appeared from the massive development of compliance expenses.

Reputed financial actors, tech firms, and legislators will work together to introduce new regulatory innovations; however, these require time for maturing.

RegTech solutions can include tools for identity verification, risk management, fraud detection, and reporting. Overall, RegTech is a growing area in fintech and is likely to continue to be an important part of the industry as regulations become more complex and technology advances.

Factually, the RegTech market size was valued at $10.8 billion in 2022 and is marked to reach $35.2 billion by 2028 at a CAGR of 22.1% during 2023-2028.

Payment Innovations

In FinTech, payment innovations have many elements, including contactless payments, mobile payments, smart speaker systems, mobile wallets, AI and machine learning for security, and identity verification technologies.

Gen-Zs will be the competent driver of payment innovations. Mobile payments have already become a major way to pay online conveniently, which will surely increase in the upcoming years. When talking about payment innovations, offline payment Wi-Fi cards and even digital payments like digital cards are also ruling the segment of contactless payments.

As per the Global News Wire, the contactless payments market size is projected to reach $12.24 billion by 2030 at a CAGR of 20.8%.

In the contactless payments, Voice Payment trend is also emerging with the projection to reach the market rate of $14.66 billion by 2030 from the value of $6.4 billion reported in 2022. And this trend is worth embracing as around 44% of people around the world are interested in making payments through voice assistance.

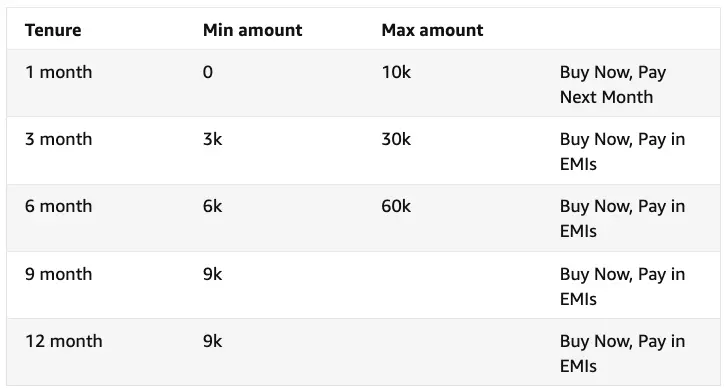

Also a new payment innovation is emerging, Buy Now Pay Later, a short-term financing revolutionizing the e-commerce finance systems. If we see, our trusted e-commerce platform, Amazon, is also offering a BNPL scheme where it asks to link credit card details to unlock EMIs on your purchase ranging from 3-12 months based on specific max amount purchase.

- One study found that around 60% of consumers have reported using a BNPL service in 2021, and 46% of them are still making payments.

- Also, around 71% of consumers reported purchasing more items online due to BNPL.

- If we see a bit older statistics collected during COVID-19 time, then clothing, electronics, and furniture items were sold through BNPL with 47%, 44%, and 32% of all financed purchases, respectively.

- Seeing this, consumer spending using BNPL services is expected to reach $437 billion by 2027 globally, with a 290% increase from 2022.

- Moreover, BNPL services adoption rate is expected to reach $576 billion by 2026.

And indeed, more payment innovations are yet to be seen!!!

Embedded Finance

Embedded finance is an integrated system that incorporates financial services and products into non-financial applications, like social media, e-commerce, etc. It is a seamless and convenient FinTech solution allowing consumers to access financial services by staying in the online platform they are using.

But to embrace this trend, financial and non-financial firms opting for embedded finance must partner up and integrate their APIs.

Some of the popular use cases of embedded finance include:

- Buy now, pay later (BNPL) integrated into e-commerce platforms;

- Make the investment and explore trading through social media;

- Mobile wallets linked to online banks and other payment functionalities, like UPI, card payments, etc.

In turn, the adoption rate of embedded financial services was valued at $20 billion in 2021 and is predicted to double the size in the next 3-5 years, says McKinsey.

InsurTech 2.0

InsurTech is a distribution innovation that takes insurance operations to the digital level. It offers the next level of convenience to the consumers to quickly get their insurance copy and claim it without relying on any agents, and that, too, cost-effectively.

When implementing InsurTech with AI/ML technology, it helps to get accurate data on risk assessments. And utilizing that, insurers can reduce administrative costs, enhance risk management, and enable a more personalized customer experience.

This trend has been adopted extremely, especially after the COVID-19 pandemic. As per the Grand View Research study, the global InsurTech market size was valued at $5.45 billion in 2022 and is expected to grow at a CAGR of 52.7% during 2023-2030.

Indeed, if you’re from the insurance industry, this is surely a trend to adopt for better business governance, as top financial businesses like ACKO, CRED, and many banks have found.

Personalization

Finance is all about numbers and managing them effectively in a digital platform, like a FinTech solution; personalization is in high demand. And when a consumer gets a personalized financial dashboard, what else do they need?

One survey states that around 50% of digital banking consumers expect their banks to offer online banking services with the touch of personalization.

It is not limited to digital banking but also can be done on InsurTech, money management, or any other FinTech solutions you want to build.

Indeed, personalization is the future of the FinTech sector!

Sustainable Finance (SuFi)

As there’s a lot of Tech adopted across industries, it is considered to get higher carbon footprints, resulting in environmental damage. As per one survey, FinTech features on the homepage can generate an estimated 4.66g of CO2 per view.

So, considering that, FinTech businesses can and should opt for Sustainable Finance (SuFi), promoting sustainable development to address ESG (Environmental, Social, and Governance) challenges.

The ledger of SuFi for FinTech development includes green bonds, sustainable investment platforms, carbon footprint tracking, and ESG rating settings. And that could include migrating to cloud platforms from on-premises infrastructure.

Alliance for Financial Inclusion

FinTech promises huge advantages not just to countries but also to every client. FinTech, if done with no appropriate strategy, would drive already marginalized players away from the prevailing.

The foundation of the AFI (Alliance for Financial Inclusion) is a great step towards safeguarding that FinTech doesn’t leave out significant sectors of societies as it shifts, fast-changing the worldwide economy.

In Summation

The financial services industry is rapidly growing. The FinTech trends we have mentioned above have evolved regarding clients’ demands. They help providers deliver greater financial services that permit enhanced availability of financial data, faster transaction processing, enhanced transparency, better assistance for the client lifecycle, and more secure identity verification.

The FinTech revolution is becoming stronger. Therefore, you don’t want to be left behind to follow the FinTech trends and provide your consumers with world-class digital financial services.

But to build your mission-critical FinTech solution, you do need an ally. Why worry when MindInventory has your back? Contact us today with your FinTech app development and upgrade requirements!

FAQs on FinTech Development

FinTech solutions can be developed using many industry-leading technologies, but if focusing on trends, then blockchain, AI/ML, cloud computing, and data science are commonly used.

When developing a trendy software solution, especially in the FinTech segment, challenges will be there, such as security risks, regulatory compliance, integration with legacy systems, talent acquisition, user experience, and, finally, the cost.

The FinTech solution development factors include a selection of the right technology, research on user experience, security and privacy, scalability and reliability, regulatory compliance, and integration with legacy systems.

Well, deciding on the right time to fully develop a FinTech solution is a bit difficult as it depends on various factors, including the project complexity, the development team scale, their experience, and so on.

The cost of developing a FinTech solution can vary across a range of factors, including project complexity, the design and development team size, the country of developers, technology and infrastructure requirements, research criteria, no. of screens to design and implement, hosting platforms, and many others. Still curious to know about the cost to develop your mission-critical FinTech app? Share your project requirements today!