Top 10 Fintech App Ideas for Startup

- Mobile

- March 7, 2024

The Fintech sector has shown a significant growth trajectory in various segments offering tremendous opportunities for startups to capitalize on this growth by providing users with an innovative Fintech app. The main focus of the post is to present some innovative Fintech app ideas that aspiring entrepreneurs can consider for their next business venture.

Introduction

With the introduction of technologies like blockchain, big data, and artificial intelligence, the Fintech industry has grown tremendously. The reason – these latest tech-empowered apps revolutionize the way customers bank, invest, and manage their money.

The Fintech ecosystem is looking very bright offering ample opportunities for aspiring entrepreneurs to give Fintech App ideas a shot and make their dream to make it to the list of Fintech Unicorns a reality.

For entrepreneurs, it is critical to understand that a well-chosen app idea holds the power to address existing market gaps, cater to evolving consumer needs, and differentiate the startup from competitors.

Before exploring the mobile app idea, let us first understand the fintech market.

Fintech App Industry Breakdown: Statistical Overview

It’s the numbers that speak volumes!

Key data plays a crucial role in the decision-making process of any startup entrepreneur. Here are some key insights for startups seeking a comprehensive understanding of the current and future potential of the fintech sector:

- The market is further expected to reach USD 792.50 Billion by 2032, according to The Brainy Insights.

- In fintech, the largest market is estimated to be Digital Assets with an AUM(asset under management) of US$80.08bn in 2024.

- The Digital Assets market is projected to encompass a user base of 992.50 million users by 2028.

- According to Statista’s projections, the total transaction value in the digital investment segment comprising automated investment services (Robo-Advisors) and online trading services is set to reach US$2,791.00bn by 2024.

- As mentioned in Forbes, by the year 2025, the embedded finance sector is projected to reach a value of $141 billion, fueled by increasing demand from traditional industries such as vehicle manufacturers, hotels, and so on.

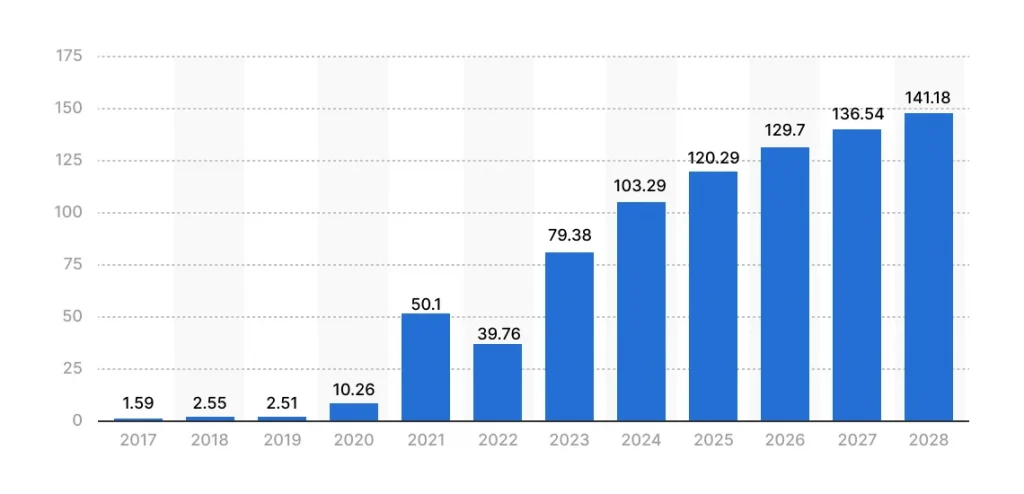

- As per Statista Market Insights, the global fintech sector is forecasted to surpass the growth of 141.18 billion U.S. dollars by the year 2028.

Well, the industry sure shows favorable conditions but it is only the innovative fintech app development idea that would provide your startup a breakthrough in the market.

Top 10 Fintech App Ideas

The fintech sector is currently experiencing unprecedented growth, offering innovative solutions to meet the evolving needs of consumers and businesses alike. Which makes it inevitable for startups to quest for unique and impactful fintech app ideas.

Here are some such ideas that startups can consider:

Crowdfunding App

With the increasing number of startups, there is a requirement to raise funds. Crowdfunding enables not just startups but also fund seekers in general to access a global pool of potential investors from venture capitalists to individual contributors and financial institutions.

Currently, the global crowdfunding market is valued at 1.41 billion U.S. dollars and according to the forecast by Statista, this market is estimated to double by 2030 with a CAGR of 14.5 %.

Check out how MindInventory helped ACE – an NFT crowdfund exchange platform, to facilitate the fans and admirers to support their favorite creators, artists, and businesses and vice versa with crowdfunding and social networking.

Cryptocurrency Exchange Platform

With around 708 crypto exchanges in the world and the number of cryptocurrency users expected to increase to 992.50m users by 2028, these currencies are going mainstream as many financial institutions are adopting them.

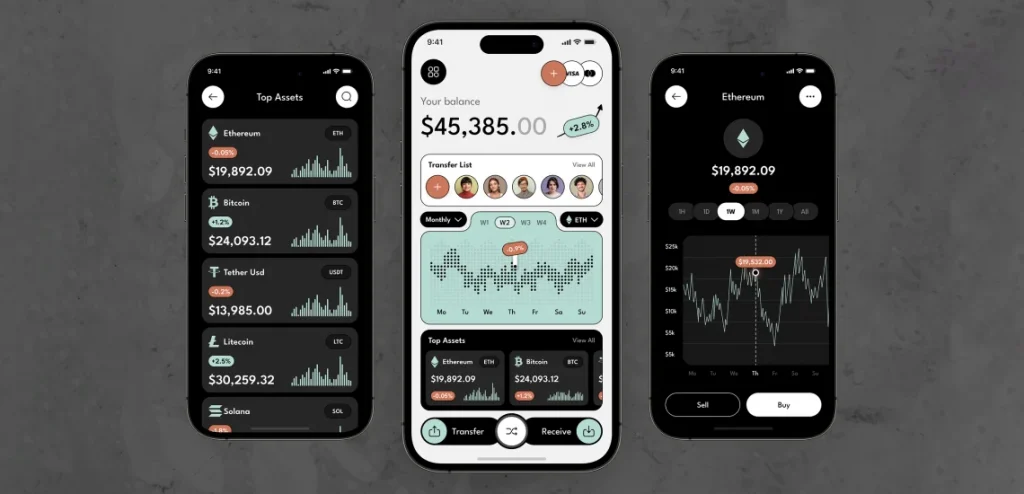

Source: Crypto Wallet Mobile App

These platforms like Binance, Coinbase, KuCoin, etc, facilitate the buying, selling, and trading of cryptocurrencies like Bitcoin, Ethereum, Dogecoin, and more. These web and mobile applications offer a wide range of features from basic to advanced like spot trading, futures trading, and margin trading. Along with services like staking, lending, P2P transactions, and decentralized finance (DeFi) products.

Also Read: How to Create Your Own Cryptocurrency

AI-Powered Investment Advisor

With an estimation of an increase in the number of users in the Robo-Advisors market to 34.020m users by 2027, the market is expected to project a total amount of US$2,274.00bn by 2027 with a CAGR of 8.06% during the forecast period of 2024 to 2027. This hints at the growing popularity of and adoption of Robo-Advisors.

The Fintech startups in collaboration with the leading generative AI development company can use the power of AI/ML technology features such as predictive analytics, natural language processing, and machine learning algorithms to empower these robo advisors to analyze market trends, assess risk, and provide personalized investment recommendations tailored to individuals based on their profiles and financial goals.

In a successful collaboration, we have played a pivotal role in enhancing Sidepocket, a tactical asset allocation robo-advising app. Our development expertise has effectively addressed and overcome backend bottlenecks, ensuring a smooth and efficient user experience.

This is just one of the aspects of AI in Fintech. To know more about how this next-generation technology will influence this industry, explore our blog, How Will AI Take Forward the FinTech Industry in 2024?

Peer-2-Peer(P2P) Payment App

Peer-to-peer (P2P) (digital lending) was worth US$43.16 billion in 2018 and is expected to rise to US$567.3 billion in 2026 with a CAGR of 26.6% in this forecast period.

Instant payments are the new normal and facilitating them are P2P apps like Zelle, Paypal, Google Pay, Apple Pay, Venmo, and more. Apart from convenience and accessibility, one thing that has been the catalyst to the rapid adoption of these payment apps among users is security.

P2P payment apps prioritize security, implementing advanced encryption and authentication measures such as end-to-end encryption, multi-factor authentication, biometric authentication (such as fingerprint or facial recognition), tokenization, and real-time fraud detection algorithms.

Must Read: Top FinTech Trends To Watch Out For In 2024

Blockchain-Powered Payment App

Unlike the conventional platforms run by centralized authorities such as banks or payment processors, blockchain-powered payment apps operate on decentralized networks, utilizing electronic distributed ledger technology to facilitate secure and transparent transactions directly between users.

As it eliminates the requirement of intermediaries, these apps offer users features like instant payments, reduced fees, and immutable transaction records.

With its use of this trending technology, the team of designers and developers has assisted in overcoming the technological challenges of a leading NFT marketplace – AltairNFT.

Trading and Investment App

Whether it be Finfluencers or accessibility to learning platforms and higher risk appetite, stock exchanges around the world are witnessing a substantial rise in retail investments. Above all, one of the major reasons for it is the user-friendly trading and investment apps.

According to the data from Finbold, six top investment apps have collectively accumulated a whooping 131.22 million downloads worldwide since their launch in 2015 until February 2023. This suggests a sharp rise in individual retailers.

Source: Stockup – Stock Market App

Apart from facilitating the buying and selling of stocks, these apps offer the convenience of monitoring their investments, personalized investment recommendations, seamless integration with banking and brokerage accounts, advanced charting tools, educational resources, and everything that a user might need to navigate the financial markets effectively.

These apps are not just limited to facilitating stock trading, they also include Forex trading apps, Mutual Fund and ETF investing apps, and more.

Digital Lending Platform

Utilizing innovation to serve segments of borrowers and lenders with a market size of $11,325.13 billion enables your startup to not only revolutionize the process but also offer an efficient borrowing experience that was not positioned in the conventional lending approach.

These platforms are a win-win situation for both the lenders(financial institutions or individual stakeholders) and the borrowers. It enables lenders to offer faster services, has lower operating costs, higher ROI, reduces administrative burdens, and more.

Borrowers, on the other hand, can benefit from easier access to credit, instant approvals, transparent terms, faster disbursals, competitive interest rates, repayment flexibility, better customer support, and more.

The digital lending platforms comprise different types like Peer-to-Peer lending apps, invoice financing apps, Buy now, pay later (BNPL) apps, and more.

| 💡 Don’t let competitors snatch your app idea! The fintech market is getting saturated with many similar apps competing to increase their revenue making it inevitable to patent your app idea. Unsure where to start? Our blog on How to Patent a Mobile App Idea has all the information you would need. |

Mobile Banking App

With various digital financial instruments, digital payments have become the new normal. With an anticipated market size of USD 18.7 billion by 2030, Mobile banking is showing bright prospects in terms of growth making it one of the reliable fintech app ideas.

The only task that remains for the startups, is to develop a mobile banking app that caters to the modern payment and banking requirements of the users.

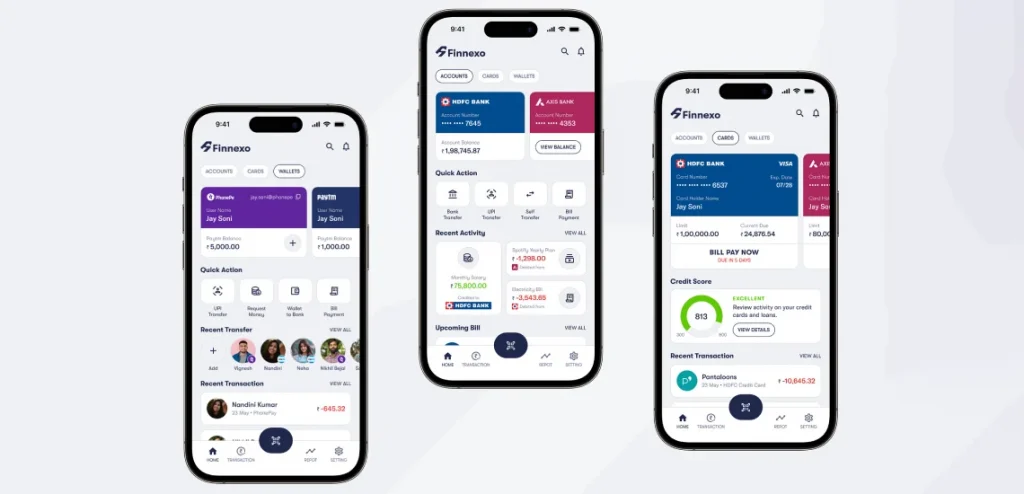

Source: Finnexo Fintech App

An ideal mobile banking app comprises of features:

- Biometric authentication

- Personalized financial insights

- Card management (activation, blocking, etc.)

- Multi-currency support

- P2P transfers

- Investment portfolio management

- Loan and credit card applications

- Virtual assistant integration

Explore Our Work: How MindInventory and Finnexo collaborated for the development of a banking and investment management app.

Digital Wallet App

According to Forbes’s poll, around 53% of Americans use digital wallets (with PayPal holding a majority) more often than traditional payment methods influenced by various reasons.

These apps enable users to make seamless transactions both online and in-store, transfer money to friends and family, pay bills and track their expenses effortlessly. These walls also offer budgeting tools, loyalty cards, coupons, and rewards programs to enhance the user experience and make eWallet apps a must-have tool.

These consumers have adopted the use of digital wallets to an extent where their shopping habits are influenced by the unavailability of digital payment options. This poses eWallet mobile app development as a bright opportunity for Fintech entrepreneurs to capitalize on this adaption and channel it into a successful app idea.

Point-of-Sale Software

Facilitating both B2C and B2B transactions for small businesses and retailers, the market size of POS software is expected to reach a size of 42.5 billion U.S. dollars by 2027.

With a POS app, businesses can process payments efficiently, track sales in real-time, manage inventory, and generate insightful reports to make informed decisions. By streamlining the checkout process and offering various payment options, such as credit cards, mobile wallets, and contactless payments, the POS app simplifies transactions for both businesses and customers.

For businesses, especially retailers to handle transactions better, POS software is currently one of the most efficient and effective choices regardless of the industry making it an investable app idea.

Once you have the Fintech app idea finalized it is time to begin with Fintech app development. To successfully develop and launch a fintech app that meets the needs of your target audience, delivers value, and drives business growth, read our blog on how to develop a fintech app.

Accelerate Your Fintech Startup Journey with MindInventory

MindInventory is a trusted partner for mobile app development, offering a blend of technical expertise, industry knowledge, and a commitment to delivering innovative solutions. We prioritize security, compliance, and user experience to ensure the success of your Fintech venture.

Our team comprises skilled developers and designers who are keen to embrace innovation and customization, leveraging the latest technologies and best practices to create unique, feature-rich Fintech apps that resonate with your target audience and drive business growth.

Partner with MindInventory for your Fintech app development needs. Contact our expert team, to build the next generation of fintech innovation together.