Developing an Expense Tracking App – Must-Have Features Your App Needs

- Mobile

- June 7, 2021

In this world of the internet and technology, everything is easier now. But managing your finance can be a tedious task on your own. So, it’s better to download an app and fulfill your requirements. These days, apps are ruling our world and mobile app development has brought much advancement in the finance industry also.

In fact, mobile app development does a great job regarding financial and Blockchain technology. This technology makes things easier for people who need to handle their earnings and expenses efficiently. This blog discusses the essential features that mobile app developers should include in the expense tracking app.

Why Should You Develop an Expense Tracking App?

Business persons find it tougher since their income varies each month, which is why it becomes more crucial to handle a budget.

An expense tracking app helps track receipts, keep income records, make a budget, handle taxes, track income vs. expenses, sync cards, and do more with total security. Expense tracking app development is one of the best trends today and many people are using them already.

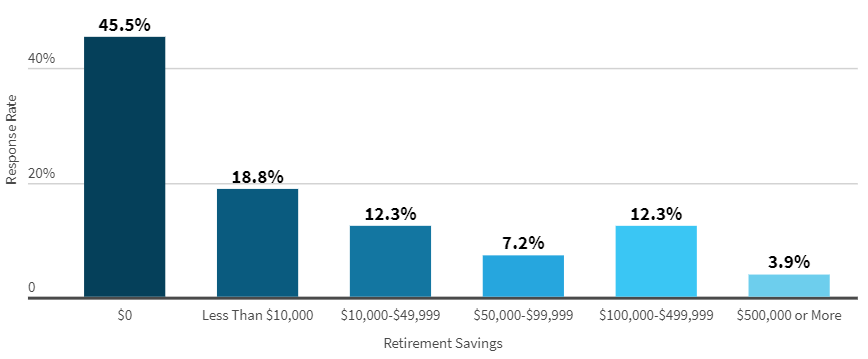

In the USA, 45.5% of individuals haven’t saved anything for their retirement. As a result, they may be in trouble after their retirement.

A survey denotes that 26% of Canadians scored less than 50 in terms of financial wellbeing. Out of this 26%, 7% have scored less than 30 and are struggling much whereas 19% have scored between 31 and 50 and are somewhat facing struggles.

Now you know the real facts that prove the importance of an expense tracking app. Take a look at some points below which discuss how an expense tracking app can help you deal with your finances seamlessly.

1. Handles Documents

It’s time to stop using paper and excel spreadsheets for keeping records of your cash payments and online transactions! Papers are tough to handle and more dangerous for the environment.

On the other hand, excel sheets may offer an online solution but don’t do much help in money handling. So, it’s better to develop money management software that collects insights from the data and helps make business decisions.

2. Tracks Receipts

You always can’t find the cash and digital payments made by you and this is a big issue with tracking expenses.

So, if you want to keep a track of your monetary investments, you should go using a business expense tracker app. This helps store all receipts by only clicking their images in your expenses handling app.

3. Prevents Data Losses and Frauds

Manual handling of personal expenses and finances can’t check every transaction detail accurately.

For this reason, fraud cases happen many times. Using an expense tracking and budgeting app, the workflow of money and finance handling becomes automated. This not just prevents fraudulence but also makes the procedure more accurate and transparent.

4. Mitigates Human Errors

We cannot afford mistakes when it comes to handling budgets and finances. However, humans may make some errors because of misunderstanding, carelessness, or negligence.

With the help of an expense handling app, you can lower as well as prevent every mistake caused because of carelessness.

5. Offers Precise Analytics

Excel spreadsheets might track and store data and create helpful charts or graphs from it but still have no advanced functionality. On the other hand, human engagement brings the possibility of mistakes.

So, it’s best to build a business expense tracker app that carries out prediction analysis and helps you make efficient business decisions.

Crucial Features to Add to Your Expense Tracking App

Before finding a reputed app development company for developing an expense tracking app, know your requirements and the functionalities you want in your app. You don’t have to know every detail, but you need a brief concept about it.

Hence, I have compiled a list of essential features that you may add to your expense management software solution.

1. Tracks and Arranges Receipts

This feature or functionality fix the problem in case you forget about some costs or miss out on some transactions. You only require clicking an image of the receipt every time you create or get cash or online payment. Put it under the precise category and the expense tracker will remind you of it.

You won’t lose those images as they are saved on the cloud. Moreover, the receipts are also streamlined properly so you can retrieve them whenever needed.

2. Approves Invoices and Payments

Money management app allows bank transfers, debit and credit card transactions, net banking, and UPI payment processes.

So, using such an app helps you track your statements’ status and the credit card bills within the application. Moreover, you can create professional invoices along with a logo.

3. Streamline Tax Deductions

Need to file taxes? Simply import your documents to the app. It will easily streamline all expenses and income into tax categories. Expense tracking app can organize your business expenses into a relevant tax category, helping you track more of what you earn.

4. Protects Data

Security is always the prime concern for every FinTech app developer. And an expense handling app maintains such a security level constantly. Moreover, it can restore users’ accounts in case their devices get lost or stolen.

5. Analytics and Insights

This feature helps you get ready-made reports that have comprehensible visuals, charts, and graphs. These reports can be utilized for assessing and building insights.

You can prepare this function as your app’s in-build analysis tool so the users can simply understand how properly their businesses are functioning.

6. Tracks Stock

You don’t need to develop an exceptional app for handling your inventory. Your expense management software can do this task for you.

This app can track goods and their expenses and give notification if stock runs low. Moreover, you can view which product is more in demand and which is not.

7. Tracks Sales

Your expense tracker app works as an eCommerce solution also. With the integration of the feature of a mobile card reader, you can accept credit cards and can sync with famous apps also.

Moreover, you can connect to eCommerce APIs that you like to use. This app assesses taxes automatically on your invoice.

8. Creates Reports

Money management software allows you to run and create reports of expenses, loss and profits, balance sheets, and revenues. In case you need the advance reports, you can utilize this feature and produce the budgeting and inventory reports.

9. Automate Workflows

This feature saves a lot of time that you would generally invest in creating, sharing, and assessing reports. You can analyze reminders that send notifications depending on the requirements of your business solutions. Furthermore, these automated reminders increase cash flow, boost client relationships and sales.

10. Deal with Contractors and Vendors

In an expense management app, you can add details of contractors and vendors and assign them categories. Additionally, keep records of all the payments made by you to them, such as how much, who, and when you have made those payments.

11. Robo-Investing

This feature produces algorithmic investment solutions and assesses, monitors, and enhances variety in investments. This app helps optimize portfolio data and change that big data into unbiased and actionable investing info easily and quickly.

Robo-investing helps get financial recommendations easily. Moreover, first-time investors can easily trade real stocks in real-time with real costs with no risk of actual money.

12. Micro-Investing

This feature or functionality helps you invest in small amounts. So, there is no headache in thinking about larger investment solutions. You can do manual investments or easily automate monthly investments as per your account balance.

13. Credit Monitoring

This feature showcases present credit scores, updated weekly scores, and offers the score a rating like good or fair. Improvement in a similar element will give notifications about credit score change through customized recommendations and push notifications for credit items, depending on your present credit score.

14. Budget vs. Actual Expenditure

Many expense-handling software solutions showcase the difference between expenditures and income. Undoubtedly, this helps but you must see the full picture to receive detailed insights.

Thereby, you should also have total details of the budget and how much will be invested in real-time. Furthermore, this helps follow the budget and make solutions like reducing unwanted costs.

15. Chatbots

Chatbots are engaging and amazing messaging interfaces. You don’t require learning the ways of using other applications. You can simply talk to the bot like you do with others.

Chatbots are completely equipped to understand all your requirements and questions. This feature of an expense tracking app helps monitor your account balance seamlessly.

16. Travel Budgeting

This feature helps make a budget before an employee goes on a business tour. You can add the tour destination and get a graph or chart made as per their convenience. Then, you can allocate resources depending on the expected travel expenditures. This will help you save lots of money invested in business trips.

17. Discounts

This feature helps in saving by giving discounts on products you require depending on your choices when you need them.

Moreover, it discovers and showcases unique discounts on products you want to purchase or find less costly substitutes to the same products close to the time of buying. This app does not just tell how to save money but also provides solutions for saving it.

18. Prediction Analysis

Artificial Intelligence knows your finances, expense behavior, and predicts your further purchases. Also, it provides unique info about how to save money.

From how much to spend to where to spend your money, you will learn all the factors that can lead to fluctuations in your expenditures.

19. Recurring Bills

An expense tracking app also tracks particular transactions and bills that occur at frequent intervals. You can enable the app for taking care of recurring costs. This will automate and enable the seamless operation of recurring costs, checks, and invoices.

20. Secure Access

It’s tough to always manage all the accounting on your own. So, through this app, you can give secure access to your users. Moreover, you can give some specific access to some functionalities of the expense management app to reduce mistakes.

This app also helps empower work for improving your team’s productivity and proficiency. With the help of this app, the entire team can be on a similar page so they can easily share the data.

How Much Does It Cost to Build an Expense Tracking App?

The cost of developing a mobile app depends on different factors. After all, your system is integrated with many features and functionalities.

When it comes to deciding the cost of expense tracking app development, many things come into the picture. Operations, aesthetics, features, and app platforms play a pivotal role in deciding the cost.

Take a look at the factors that may impact the cost of a money management software solution:

- Size of the app development team

- Designing prototype and witeframe

- Basic and advanced features

- Technology advancement

- Location of your development partner

- Third-party integrations

- Support and maintenance

Ending

So, these are the crucial features to add to an expense tracking app. In case you feel the need for any other features to make your app different from others, you can add them according to your business requirement. Building such an app helps you maintain your expenditure and profit with ease.