How To Develop A Fintech App? A Step-By-Step Guide

- Mobile

- November 16, 2023

Fintech app development has become one of the most sought-after opportunities for businesses, given the significant growth of the fintech industry. If you are also looking to develop a fintech app, this blog has you covered. This post provides insight into what fintech is, its future, types, must-have features, key development considerations, fintech app development cost, mistakes to avoid, and more, along with a step-by-step fintech app development guide.

The fintech industry is growing at an unprecedented rate, with new apps and platforms launching every day. In fact, the American region alone saw over 13,100 fintech startups till January 2024, (the highest in the world), followed by 10,969 in the EMEA region and 5,886 in the Asia Pacific region. According to AlliedMarketResearch, the global fintech technology market size is projected to reach $698.48 billion by 2030 at a CAGR of 20.3%.

In this very dense market, gaining a competitive edge becomes a necessity. By tapping into fintech app development trends, you can fuel your mission to be unique in the market.

Imagine watching a blockbuster movie where the tech-savvy hero searches for advanced gadget development ideas that let him do financial wonders. And that’s where you start vibing with his thrills, and your mind starts buzzing with countless ideas and possibilities.

Luckily, you don’t need to be that Hollywood hero! With this blog full of ideas and approaches, you can identify the right fintech app development ideas, features, and capabilities, find the right mobile app development team, and follow fintech app development best practices, to unleash your inner fintech superhero and take the financial world by storm.

So, keep your excitement high as we begin the journey of learning fintech app development.

What is a Fintech App?

Fintech, a term derived from ‘financial’ and ‘technology,’ refers to the use of the latest technology to improve, automate, or deliver financial services.

A Fintech app (financial technology application) is a digital solution designed to make financial services accessible through mobile and web platforms. These digital finance solutions can include web, mobile, or desktop apps that facilitate services such as online banking, trading, budget management, and digital payments.

With the use of modern technologies like AI/ML, Blockchain, and more, fintech companies can innovate online financial services with high-end security and performance.

In fact, Fintech apps have become the go-to solutions for tech-savvy consumers, such as entrepreneurs, companies, and banks looking to use secure, reliable, scalable solutions which save them ample time and effort in dealing with finances.

How is Fintech Shaping the Future of Finance?

Undoubtedly, Fintech plays a key role in shaping the finance sector. Fintech apps come with many revolutionary benefits and solve many financial industry problems that consumers face nowadays:

Facilitates many payment options

The evolution of fintech has brought up various innovative contactless payment methods, such as e-wallet, UPI, net banking, cryptocurrency, and more. While these payment options are revolutionary, they also require more attention to security. However, with advanced technologies at your disposal, you can leverage them to enhance the security of these payment methods.

Access to more financing options

Fintech has disrupted the credit market with its innovative offerings. In the past, new businesses and startups faced difficulties in obtaining loans from traditional banks. However, with the emergence of new fintech services like peer-to-peer loan platforms, they can now receive loans more easily and even pay them off faster.

Overcoming financial exclusion

As per the World Bank survey, worldwide account ownership was approximately 76% in 2021, while the remaining 24% still do not have bank accounts due to various reasons, such as the inability to meet minimum balance requirements.

Thanks to the fintech revolution and companies like Google Pay, Sage Pay, Square Cash, Jupiter Money, and many others, banking has become more accessible and convenient for users. With online banking, you can perform all your transactions at your fingertips.

Access to investment opportunities

The investment sector was once very traditional, and many people faced barriers to accessing it. However, fintech app development has brought about a drastic change by simplifying access and enabling users to practice their investment skills. Popular examples of such apps include Robinhood, Acorns, Coinbase, and many others.

Common Types of Fintech Apps

The financial sector is a considerably wide sector and covers many types and categories of apps, which you must know. So, let’s overview them:

1. Digital Banking Apps

Digital banking apps are mobile or web-based applications provided by banks to enable their users to access their bank accounts remotely and perform a variety of banking activities like checking account balances, viewing transaction history, paying bills, and more. These apps offer features like account management, fund transfers, loan applications, bill payments, money deposits, and more.

Today, not only Fintech startups are creating such apps to enter the market, but also traditional banks are building mobile banking apps, offering varying services online to tech-savvy customers.

Moreover, mobile banking has become a mainstream platform for accessing financial services due to its reliability.

Some popular digital banking apps include Chime, Ally, and Starling.

2. Insurance Apps

These apps provide policy purchasers or holders with easy access to purchase or manage insurance plans and processes directly from their mobile or web devices. The ultimate goal is to enhance insurance policy administration and simplify the process of purchasing, managing, and claiming insurance while reducing the risks of insurance fraud.

Moreover, such apps offer a wide range of features such as policy management, policy purchase, claim processing, payment and billing, quoting and comparison, customer support, and more.

Some popular insurance apps are Oscar, Policygenius, and Lemonade.

Also Read: How to develop an auto insurance app?

3. Investment Apps

Simply put, investment apps enable individuals to buy and sell various financial instruments such as stocks, bonds, exchange-traded funds (ETFs), mutual funds, and more, as well as manage and monitor their investments from their smartphones, tablets, and web devices.

There was a time when stock investment wasn’t easily accessible to people. Thanks to the digital emergence in the financial industry, now anyone can easily open a demat account and start trading instantly and get better insights to decide on what to invest in next.

In this category, Robo-advisory Apps powered by machine learning algorithms are becoming very popular these days as they provide data and risk-based investment advice to users to get the most out of their investment.

Acorns, Robinhood, and Invstr are globally popular rich insight-based investment apps. Moreover, Binance, Coinbase, and WazirX are popular crypto trading apps.

4. Lending/Loan Apps

They are created purely from the user perspective to provide users with quick loan access, either through traditional or peer-to-peer lending platforms. They offer better opportunities to both traditional financial institutions and independent digital lenders.

Such apps can have features such as easy-to-fill load application forms, billing, credit score checker, additional offers/rewards, and more.

Dave, Earnin, PaySense, and Kiva are the popular apps in the categories of loan and peer-to-peer lending apps.

5. Regtech Apps

The financial industry is sensitive and requires robust regulations, as any financial decision can potentially impact the economy and individual’s finances. Additionally, it must protect sensitive financial information, such as bank account information, social security numbers, and credit scores, from potential fraud and identity theft.

Therefore, Regtech apps provide great assistance to financial institutions in ensuring compliance, managing identities, monitoring risks, and reporting to regulators. They heavily rely on emerging technologies like Machine Learning and Big Data to automate regulatory operations.

PassFort, 6 clicks, and Alyne are popular Regtech apps revolutionizing fintech operations.

Also Explore: Top 10 Fintech App Ideas for Startup

6. Personal Finance Apps

Personal finance apps assist individuals in managing their personal finances effectively through a wide range of features and tools to track income, expenses, savings, investments, and financial goals.

They help users manage their finances in many ways, ranging from educating users by providing insights and offering digital accounting operations to providing personalized tips for effective finance management.

Mint and PocketGuard (budgeting apps) and Personal Capital (a comprehensive financial management app) are popular personal finance management apps.

Top 6 Features You Can Include in Your Fintech App

Your fintech app is critical to your finance business. To provide a better user experience, you must implement the following important features and functionalities:

1. Advanced login/sign in

It is important to implement this very first app page for users to create an account (sign in) or login to it to unlock their personalized user experience.

However, it is crucial to make it advanced by implementing the two essential security app login features, such as biometric unlock/authentication (either through face, iris, or fingerprint unlock) and two-factor authentication (password/pin + OTP), to avoid the risks of account theft.

Implementing these features not only provides security but also helps in managing financial regulations and compliances.

2. Account management

After signing in or creating an account, users need to add their specific information to use the app more conveniently.

This feature allows users to add their additional account information, such as their name and contact information, manage privacy and security settings, check their balance, automate payment transactions, set budgets, and more.

3. Payment gateway

The payment gateway integration feature enables users to link their prioritized bank accounts and payment cards with your fintech app making their payment transaction journey a breeze.

4. Push notifications

These are the pop-up messages that appear in the box form in the header/notification bar of the users’ phones when they are not using your app.

Push notifications are the ways you can remind your users to use your app and you can play with your app service marketing to improve your app user retention rate.

5. Transaction history

While checking their account balance, users also want to review where they have spent their money and from whom they have received the money. The transaction history makes it easier for them to go through past transactions, deposits, withdrawals, purchases, and more, along with dates, times, and other account details – in short, providing a complete statement in one place.

6. Chatbots

When seeking quick help anytime, chatbots have proven effective in serving customers. This AI in Fintech trend allows customers to chat with AI-powered bots, which continuously assess and adapt to ease their difficulties.

By implementing AI-powered chatbot, you can enhance the user experience of your pivotal fintech app and, thus, improve your business.

4 Things to Consider When Building Your Pivotal Fintech App

We know that you want your fintech app to be perfect. Hence, here, we have mentioned a few considerations for your fintech app development project:

1. Security

When building your fintech app, security should be your primary concern as it is a sensitive sector dealing with many sensitive information. Hence, many financial regulatory firms came into action and implemented many conditions and rules that financial sectors must comply with. Failing to do so, and when their app is attacked by hackers, can lead to hefty penalties.

Hence, to secure your fintech app, you can implement security features such as two-factor authentication (Password/Pin + OTP or Dynamic CVV2 Codes) and biometric unlock.

Moreover, when developing a cloud-based application, you also need to consider cloud security best practices to secure your Fintech app from all end-points.

2. 3rd-party integrations

Third-party API and feature integrations help you extend your fintech app’s features and functionalities. In fact, APIs are the building blocks of your fintech app.

So, when building your vital fintech app, you can integrate the following essential APIs with it:

- KYC API integration to verify your users, like Jumio and Onfido;

- AML API integration to embrace anti-money laundering services to comply your fintech app with regulatory requirements, like Accuity and ComplyAdvantage;

- Payment Gateway to link your bank accounts and payment cards make your app accomplish inter-bank transactions, like PayPal, Stripe, Skrill, Braintree, and more.

3. Legal compliances

To save your fintech application from potential cyberattacks, you must comply with legal security compliances that offer app security best practices. You can comply with your fintech app with regulatory standards based on the service you provide and the user information you store in your database.

- If you’re storing cardholder information, you need to comply with PCI-DSS (Payment Card Industry Data Security Standard);

- When dealing with users’ personal information (which, of course, any fintech app would do), that app must comply with GDPR – General Data Protection Regulation.

So, by complying with these two and many others, you can optimize the security of your fintech app and make its online operations smoother.

4. Simplicity and usability

You want your users to simply understand your app UI; hence, you do want to design your mobile app UI/UX in such a way that not only reflects its appealingness with simplicity but also offers elevated app usability.

This consideration ensures that your newly onboarded users have a fun learning curve about your app and use it effectively to make the most out of your app, which tends to keep their interest in using your app.

In short, the simple, more soothing, and more understandable UI is, the better scope it has to attract more users and make them continue using it.

How to Build a Fintech App?

We understand how vital your Fintech app is for your business, how desperate you are to build your app, and you want to bring it to life without missing out on any detail – feature and functionality – in this case. Hence, here we have gathered each and every step you would need to create your business-specific Fintech app. Let’s begin the Fintech app development process overview:

1. Define your Fintech app development idea with market research

Before developing any app, figuring out the right problem to solve the market difficulties and finding your app niche is really important to make your app a star of the market from the beginning if it’s built correctly. So, you can simply answer a few of the questions as mentioned below:

- What type of Fintech app do you want to build?

- What Fintech operation problem areas will it solve? (personal finance, investment app, reg tech app, digital banking app, or any other)

This will help you figure out your fintech app niche. Once you’re done with your fintech app niche discovery, you’re up for the next research in line which is extensive mobile app market research and user research.

Now, you need to define what market, institutes, and types of users will be the target for your app by asking simple questions as mentioned below:

- What specific financial domain will your app target?

- Who will be your app users, and what will be their profession or basic requirements?

- Do your target users come from a specific age group, interest, or region?

- Will your app initially be limited to the regional market, and then you plan to take it to the global level?

- Does your target market have similar apps to yours?

- What features do they want to be in your fintech app?

Apart from these, you can ask and answer any related questions to make your fintech app ideation stage effective and resourceful.

2. Do a UX research

Now you know who your audience is. So, it’s time to do detailed audience research to know their pain points, what they really like to have in their fintech app, and what makes their journey in the app so smooth.

Along with that, you have to conduct detailed UX research to figure out the unique proposals that will amaze your app audience and hence help you gain your competitive edge.

Moreover, you can do detailed UX research keeping the market, audience, and your UVP (Unique Value Propositions) at the center, along with SWOT (strengths, weaknesses, opportunities, and threats) and PEST (Political, Economical, Sociological, and Technological) analysis.

All these studies will help you get nearer to your award-winning fintech app development journey.

3. Define scope of the product (SOP)

Now, you have so many things, such as features and functionalities, better ideas, design recommendations, marketing tactics, and more, on your bucket to develop your fintech app.

But don’t get overwhelmed after seeing all those ideas. You do need a clear path to start developing your market-winning fintech app. That’s where the Scope of the Product (SOP) document comes to your rescue.

So, what is the scope of the product (SOP) document?

As the name suggests, an SOP document is a detailed analysis of your app development project that outlines product boundaries by describing product description, objectives and goals, deliverables, scope boundaries, assumptions and dependencies, and acceptance criteria.

In short, it states a clear understanding of your project and the scope of the implementation requirements to avoid execution time confusions that lead to project failures. Of course, it will include product thinking that will lead you to define a solution that rocks the market.

So, collaborate with an experienced fintech app development company, like MindInventory, that assigns dedicated project managers and business analysts who can help you better scope your project.

4. Choose the right technology and app development model

Having a concrete Fintech app development idea with proper implementation planning is good, but how will you bring your imagination and documentation to life? This means you will need the right fintech app development technology at your disposal to execute your project in the beautiful way you have described it in your requirement and SOP documentation.

And these documents will become your key to selecting the right technology governing your fintech app development project.

If being with the trend, if you’re planning for the Fintech mobile app development, you have two respective technology options to choose from:

- Native Fintech mobile app development: Android and iOS

- Cross-platform Fintech mobile app development: either using Flutter or React Native

Confusion alert! Worry not! We have covered a specific guide on Native Vs. Cross-platform app development to lessen your selection criteria.

Emerging Technologies to Use in Fintech

In this tech-driven world, where data is considered the greatest asset, you can utilize three emerging technologies to ensure your business runs creatively and securely while meeting the demands of tech-savvy users:

- Data Science: Leverage the power of data at scale to derive insights and provide users with a personalized Fintech app experience. Utilize data science techniques to set your app apart from the market competition.

- AI/ML: With automation becoming common, you can leverage data and AI/ML to make your fintech app smarter and streamline its operations. Implement Robotic Process Automation (RPA) to enhance user convenience by automating tasks, such as auto bill payment, auto insurance claiming, and more, with precision.

- Blockchain: In Fintech, security should be the priority, not an option. So, consider incorporating blockchain solutions such as smart contracts to ensure immutable agreements. Additionally, utilize decentralized finance (DeFi) solutions to safeguard users’ online transactions from cyber threats and prying eyes.

After deciding on the technology stack, with many app development approaches available at your disposal, you need to decide which one to choose from Waterfall Vs. Scrum (or any other Agile methodology). However, when taking experts’ advice, they always recommend opting for SCRUM-like agile development methodologies to achieve faster product time-to-market.

5. Choose the right IT team and engagement model

Now, it’s time to decide on budget planning alongside the right IT team engagement model selection that meets your criteria effectively. There are numerous debates going on between Fixed Cost Vs. Hourly Hiring (dedicated hiring), and you probably don’t want to be choice overloaded.

Simply put, when the project scope is clear, you can go for fixed-cost hiring. But when your fintech app development project has varying requirements, and you want to experiment, you can opt for hourly hiring worry-less.

However, in both options – hourly hiring is beneficial in many ways. Still, you will want to know the right time to hire dedicated app developers and ways to hire dedicated developers for your project.

Curate a development team

After deciding on the project engagement model, it’s time to finally find the right mobile app development partner and interview developers to curate your development team. We have written an entire blog on how to find and choose the right team of mobile app developers to work on your project, which we have also linked in the above line.

To make it quick, you can check many IT services providers’ company websites and check out their portfolios and success stories that will make your work easier. Moreover, you can even contact them directly by sharing your project requirements to know more about ways they can help you.

You can hire dedicated mobile app developers from MindInventory that has been helping businesses for over a decade now with cutting-edge technology solutions. We offer different engagement models, such as time & material, monthly hiring (160 guaranteed working hours/month), and fixed-cost contracts, one of which will surely meet your project criteria.

6. Mind the Fintech compliance

As we have discussed above, when implementing your Fintech app, you must ensure compliance with privacy regulations, like GDPR, PCI-DSS, and many others, and protection systems, like KYC and AML, to know and protect your users from scams.

However, your app’s required compliance with the law varies by country. Hence, whenever building your Fintech app, you must check for the security and privacy regulations effective in your target country.

7. Create UI/UX design

Your Fintech app development idea is really effective, but it still lacks a lot if it does not have an appealing app UI/UX design. Hence, app UI/UX design plays an important role in your Fintech that ensures that your users get a smooth and amusing journey to your app. Also, it sets your brand reputation standards.

However, when crafting an app UI/UX design, ensure to avoid common UI/UX design mistakes and follow app design trends to make your Fintech app look creative and eye-catching that can resonate with your app users while easing their navigation and elevating user experience.

8. Develop an MVP

It’s really important to check the effectiveness of your Fintech app development idea, and that’s where MVP development benefits you immensely.

When developing your MVP, you don’t need to focus more on the detailed UI/UX design part but only on the core app feature and functionality part – you initially need to market your app and study the interest of your target audience.

In short, it saves you a lot of development efforts, time, and money. If your Fintech MVP gets successful, you can start implementing additional features into it and make it a full-fledged Fintech app with an appealing, navigating UI offering elevated user experience.

9. Build, test, and use feedback to iterate till you find success

Here comes the main development phase, which is also known as the iterative app development process. Your fintech app development project does not end with your app hosted on the app store.

You do need to improve it continuously to ensure its effectiveness to be updated with the technological advancements, to meet modern users’ exceeding expectations, and to outperform competitors.

To do so, you need A/B testing to check which version customers like. The following KPIs you should know to check your Fintech app performance:

- Average transaction time

- App install-to-registration ratio

- Daily/monthly active users

- Users’ time spent on your app

- App visit through push notifications

- Times app gestures become unresponsive

- Customer acquisition cost (CAC)

- Customer retention rate

Top 6 Mistakes to Avoid When Developing a Fintech App

Well, getting to know the right approach to build your Fintech app adds a plus point, but you also have to know about the common mistakes most people make in order to avoid them. So, here they are:

1. Unappealing user onboarding

The app user onboarding screens plays a vital role to teach users how to effectively use your app. It is even necessary, especially when building your Fintech app, as it contains many complex procedures.

But many Fintech companies overlook the power of creatively designing app user onboarding screens that can even impact users losing their interest in using your app, resulting in the app’s churn rate.

In short, your Fintech app’s user onboarding is your key to success. So, define your app onboarding agenda and make user onboarding a continuous process in such a way they love to explore more.

While designing your app user onboarding, also focus on the following best practices:

- Study your audience

- Stick to your app purpose

- Design WOW & AHA effects

- Always ask for their permission as a sweet gesture to send notifications

- Be aligned with your branding

- Allow users to move further or skip the onboarding process

- Don’t clutter it; stay with minimalism

2. Overloaded functionalities

Well, having a full-featured Fintech app is good that even every user would love to use regularly, but making the app cluttered with too many unnecessary functionalities can be a negative point. It can irritate users, or it will be rarely used by users.

So, whatever the matter is, it will cost you more due to more functionality implementation requirements.

3. Not focusing on UX

Whether it is a web app or mobile app, user experience plays a crucial role, especially in Fintech apps. Your users are keys to your app’s success; hence, you will need to adopt a user-centric approach to design your Fintech app UI with proper market research, effective app navigation planning, UX strategies, and a lot more planning.

In short, create user-centric Fintech app UI/UX design that they find easy to navigate.

4. Overlooking app security

Fintech apps store a lot of personal information, such as name, address, contact information, bank account details, and much more. Hence, the security of the Fintech solutions should never be overlooked.

5. Not up to the mark data cleansing

Data coming to your mobile app from other sources are often considered “dirty” as they come in various formats, from which some are incompatible. So, when using your mobile app, you might get outdated and inaccurate information and sometimes even face quality issues.

For instance, your bank account balance is $5000 but it reads $50, and this inaccuracy is faced by a data import error. This requires regular data cleansing, which is often ignored by developers.

Data cleansing helps to solve data errors and inconsistencies by retrieving data from different fintech apps using APIs like open banking. This process makes your app ready for analysis.

6. Not thoroughly testing the app

You, as a user, don’t like to use a mobile app that crashes often or throws exceptions. Hence, its quality assurance after every app development completion stage is necessary to not leave any bugs behind.

Unfortunately, not every mobile app developer gives their Fintech app for testing to certified QA engineers to thoroughly test the app. Along with app development quality testing, Fintech apps also need financial testing to comply with respective financial industry regulations.

By employing DevOps in Mobile app development, you can ensure continuous integration and testing of your mission-critical Fintech app.

How Much Does It Cost to Build a Fintech App?

The Fintech app development cost can vary from $30,000 to $120,000+ depending on the complexity of the app. Here are the factors influencing the cost of Fintech app development:

- Fintech app development type with complexity

- Fintech app design requirements

- App features and functions

- Location of the app development company

- Technology stack

- The expertise of the app developers

- No. of designers and developers you hire

- 3rd Party API integrations

- App testing

- App support and maintenance

- The development team’s engagement model

Want to know how much it costs to make an app? Here’s a detailed guide and the key factors that influence mobile app development costs.

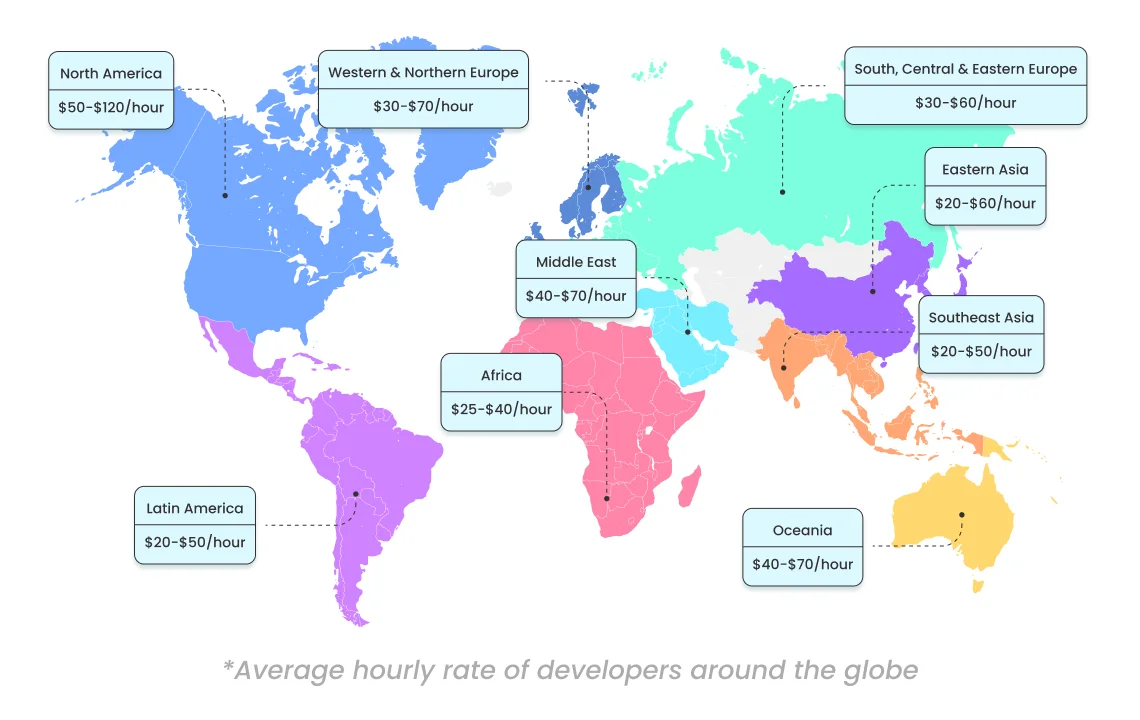

If you choose to go for dedicated hiring, the hire developers cost varies through the region, such as:

Note: Costs represented here are subjective to the respective timeline and market situation.

How Can MindInventory Help You In Fintech App Development?

By concluding this guide, we hope that you now know a lot more than just developing a Fintech app that will help you set up the scope of your Fintech app. Fintech apps not only benefit consumers but also finance businesses to easily manage their financial operations.

As a leading Fintech app development company – MindInventory holds extensive expertise in developing types of Fintech apps. We love innovations and have catered to many clients globally to develop their flagship Fintech solutions that have considerably transformed their business and helped them achieve a leading market position.

FAQs on Fintech App Development

The world is changing, and the COVID-19 pandemic acted as the catalyst for the digital transformation of businesses. With that, many tech-savvy consumers are also demanding seamless digital financial services to effortlessly manage their finances. Focusing on concerning finance sector problems can give you fast pace adoption. Moreover, you have more options to innovatively build your fintech app.

The time taken to build a Fintech app varies from 3 to 12+ months depending on the complexity of the app and other factors. Apart from complexity, factors that affect the Fintech app development timeline include the complexity of features/functionalities, third-party integration, UI/UX design, implementation of security measures, choice of platforms, development team size, experience of the team, and more.

There are various ways a Fintech app can make money, such as transaction fees, subscription models, freemium models, in-app advertising, licensing and partnerships, loan interests, data monetization, white-label solutions, and more.